Existing AAA life insurance customers can access manage their policies online by creating an AAA Life eServices account. Those signed up to the service can securely login to make payments, change billing and payment information, view policy details and access customer support 24/7. Below is the step by step process for creating an account, logging in and filing claims.

AAA Insurance login

How to Log In

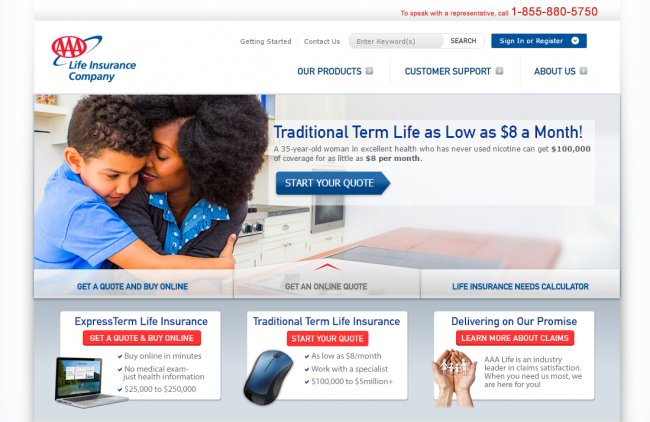

Step 1 – On the website (https://www.aaalife.com), click on the “Sign in or Register” link at the top right hand side of your screen as shown below.

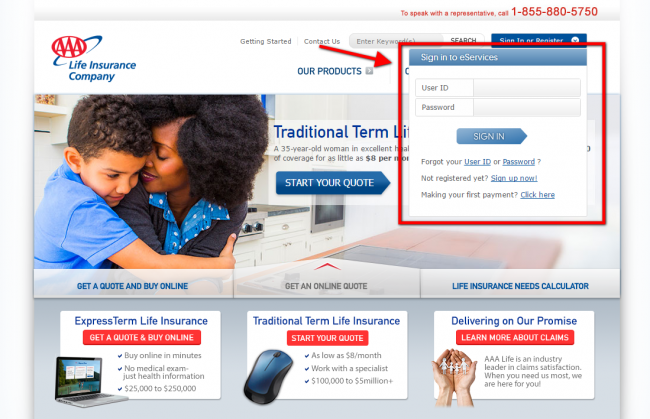

Step 2 – A sign in form with appear. Enter your User ID and password ten click on the “Sign In” button. You can now access your account.

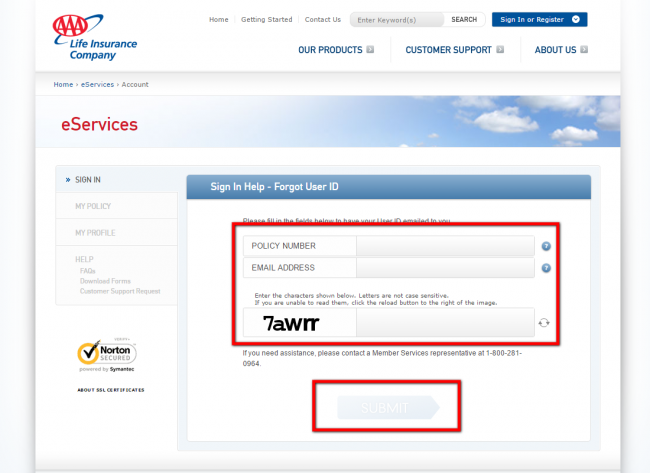

Forgot User ID – You can recover your User ID by clicking on the “forgot user ID” link at the bottom of the sign in form. Enter your email address and policy number.

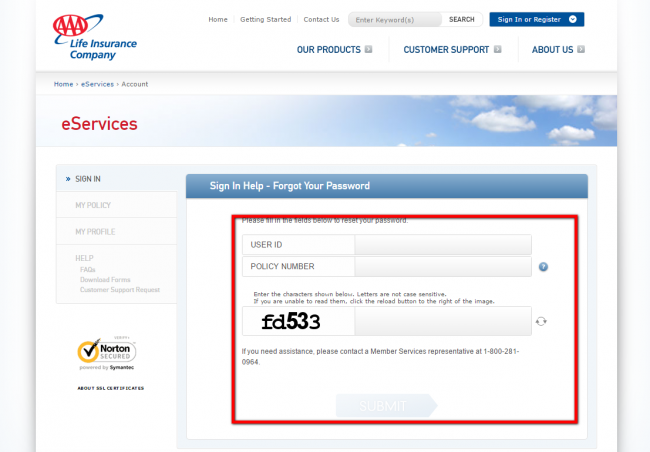

Forgot Password – You can reset your password by clicking on the “forgot password” link at the bottom of the login form. Enter your User ID and policy number.

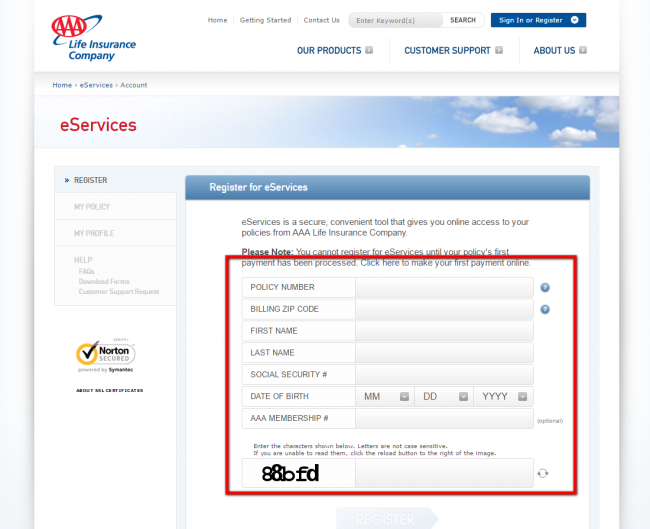

Enroll in Online Access

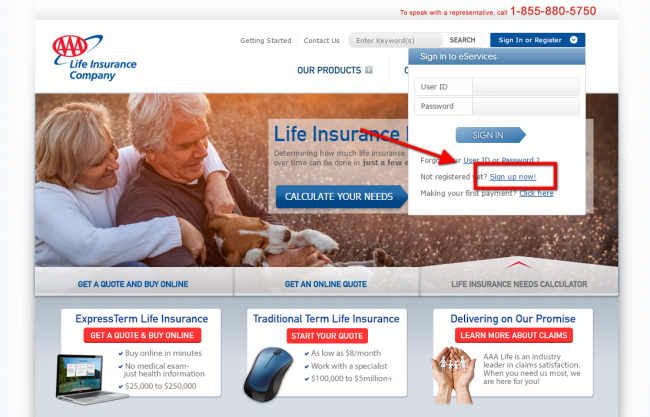

Step 1 – Go to the homepage. Click on the Sign Up Now link appearing on the login form as shown below.

Step 2 – You will be redirected to the enrollment form. Fill in your policy number, billing zip code, name, social security number, date of birth, and AA membership number (optional). Click on the “Register” button to complete the enrollment process.

Make a Claim

Claims are submitted in writing or over the phone. Call member Services at 1-800-684-4222 to submit your claim over the phone. To submit a claim in writing, send a notice of the claim to the company address, or send a fax to 1-888-223-1509. You will get a claim form and instructions pertaining to the proof of loss requirement. Submit the materials for the claim to be evaluated.

AAA Insurance Review

AAA stands for the American Automobile Association and they make up a federation of motor clubs all around North America. While they are known for being a motorist organization they also offer auto, home, and life insurance and they have been around since 1902 and were founded in Chicago, Illinois. They are a non-profit group but as a carrier, they offer solid insurance policies at a competitive price. There are over 6o million AAA members in the U.S. and Canada and they offer a lot more than what they are known for in roadside assistance. The national headquarters for the company are in Heathrow Florida.

On the main AAA member website there is AAA insurance login where you can manage and pay for your insurance policies.

Types of Coverages that AAA Insurance Offers

AAA offers auto, home, and life insurance and let’s look at the different types of coverage offered.

Auto Insurance

Here are the types of coverage for AAA auto insurance:

- Bodily Injury Liability – Usually this coverage is required to legally drive and it will help cover the costs for such things as funerals, income loss because of an accident, or paying medical expenses for others due to an accident that was your fault.

- Property Damage Liability – This will help pay for repairs or the full replacement of another person’s vehicle as well as property damage when there is an accident and you are at fault.

- Uninsured and Underinsured Driver – This coverage will help cover medical costs to both you and passengers in your vehicle if you are injured caused by a driver that is not covered by insurance or does not have enough coverage in the policy they have. (Note – there are many states in the U.S, where you are required to carry this type of coverage).

- Medical Payment Coverage – Coverage that will aid in paying medical expenses for both you and passengers in your vehicle if you are in an accident and the person at fault does not matter.

- Collision Coverage – This will help cover the expenses for both the repairs or a replacement to a vehicle you own and who is at fault in the accident does not matter. If you are financing a vehicle the lender of it will, more often than not, it is required that you have this type of coverage.

- Comprehensive Coverage – This will help pay for repairs and possible replacement of a vehicle you own if it is stolen or there is damage to it not caused by an accident.

- Personal Injury Protection (PIP) – This coverage helps with payments for such things as the loss of income, funeral expenses, and medical expenses for not only you but your family as well and it does not matter who is at fault in the accident. (Note – this coverage is not available from AAA in all 50 states).

- Rental Reimbursement – This will aid in the costs of renting a vehicle if yours is being repaired after an accident.

- New Car – This coverage will fill the payment gap in terms of the value of depreciation if your vehicle is totaled in an accident and needs to be replaced.

Additional coverage options include gap insurance, OEM exterior repair coverage, new car replacement, ride-share insurance, and custom equipment coverage.

Home Insurance

AAA is known for auto insurance but also has home insurance coverage as well. Here are the types of coverage offered:

- Other Strictures – This will help pay for damage for structures that are detached from your property.

- Personal Property – This policy will insure the contents of your home. You have the choice to increase this coverage for items that are of higher value.

- Loss of Use – This can help pay for things such as hotel or home rentals if you cannot live in your home after damage that is covered by the policy.

- Personal Liability – This coverage aids in costs to both people and property damage if the damage happens on property that you own.

- Medical Payments – This can help take care of the costs of medical expenses for others when you are at fault for injuries they sustained.

Life Insurance

Life insurance was first given by AAA back in 1969 and you do not have to be a member to purchase a life insurance policy. Still, AAA members can receive discounted policies. The life insurance offered is typical in what other carriers offer in:

Term life insurance

- Express term life insurance and not have to undergo a medical examination

- Standard whole life insurance

- Guaranteed whole life insurance

- Universal coverage

AAA Insurance Prices

AAA offers insurance options at a competitive price and for all insurance price information the most up to date can be found by visiting the main AAA insurance page and going to your AAA account login. The prices will differ more for home and life insurance. However, for auto.

insurance from AAA the minimum coverage required will typically be around $625 per year while it will be around $2000 yearly for full coverage. At the site above you can also pay AAA auto insurance and make a AAA login payment.

AAA Insurance Discounts

Here are the discounts available from AAA for both auto and home insurance and you can get more info about them by your AAA membership login on the main page.

Here are the AAA auto insurance discounts:

- AAA membership discount

- Advanced Shopping Discount – Buying a policy more than 7 days before a previous policy starts on an auto that is covered before by another insurance policy for 6 months in a row.

- Bundle – Having AAA auto and home insurance policies.

- Distant Student – Students between 15-25 years old who go off to school and leave their vehicle at home.

- Good Student Discount – College and high school students with a GPA of 3.0 or higher.

- Loyalty Discount – Continuing to renew AAA policy/policies.

- Multi-Car – Insuring more than one vehicle with AAA.

- Paid in Full – Paying your premium in full with one payment.

- Teen Smart – Drivers that complete a driving course before they are 19.

Here are the AAA home insurance discounts:

- Annual Prepayment – You can save if you pay all of your home insurance premium in one payment.

- Bundle – Having AAA auto and home insurance policies.

- Claims Free – You can save if you do not file a claim with AAA for a few years.

- New Homeowner – If you take a loan for a new home you can get a discount.

- Roof Replacement – If you replace a roof on a home that you own you can receive a discount.

- Senior Citizens – with a Mature policyholder discount you can save money.

AAA Insurance Pros and Cons‘

Pros

- Reputable company

- Offers auto, homeowners, and life insurance

- Bundle discounts

- Many discounts for auto and home insurance

- Easy www AAA com payment options

- Discounts for AAA members

Cons

- Insurance coverage and prices differ depending on where you live

- Can be pricier if you are a not a AAA member

- May not transfer policies if you move to another state

FAQ’s

How much is full coverage AAA?

There are three types of AAA membership options and the more you pay per year the more benefits you will receive. The three options and the costs are:

- AAA Classic – $59 per year ($5.99 monthly)

- AAA Plus – $89 per year ($8.49 monthly)

- AAA Premier – $124 per year ($11.41 monthly)

How do I file a claim with AAA?

You can file a claim on the claim AAA claim website and you can also do so by calling them by phone. You can find the phone numbers you need to file a claim here.

Do AAA auto club members receive a discount on AAA auto Insurance?

Yes, AAA club members can receive up to a 10% discount on AAA auto insurance. You can get more information about AAA discounts at AAA car insurance login link here.

What do I need to get a quote from AAA Insurance?

You can get a quote from AAA insurance by visiting their insurance and auto insurance websites and you can also call their number specifically for quotes at 1-855-909-2294. You can also make an AAA car insurance payment at the auto insurance site.

Summary

AAA is a very reputable company that has been in business since 1902. While known for auto assistance they not only offer auto insurance but also home and life insurance. There are discounts aplenty available and if you are an AAA member you can really save. It is quick and easy to get a quote and make a claim and you can manage your policy/policies through the AAA membership login. You can pay AAA insurance online or over the phone and the customer service department at AAA is top-notch.

Related Life Insurance Articles

- What is Life Insurance?

- Whole Life Insurance

- Term vs Whole Life Insurance

- LIRP: A Life Insurance Tax-Free Retirement Plan

- Colonial Penn Life Insurance 2023

- Life Insurance With Pre existing Conditions

- The importance of assigning a Beneficiary

- The Types of Life Insurance – Explained

Life Insurance Tips

- Is Life insurance a good career path?

- How to Start Selling Life Insurance

- How To Use Life Insurance While Alive