If you currently have an Ameriprise home insurance policy, you can make payments, update billing details, view/download important policy documents, and complete other transactions 24/7 by signing in to your online account. If you do not have an online account, creating one is relatively straightforward (instructions are posted below). Non-login payment options are also available, however in order to set up recurring forms of payment, users must sign in to their account. Instructions for filing a home claim can be viewed at the bottom of this page.

How to Log In

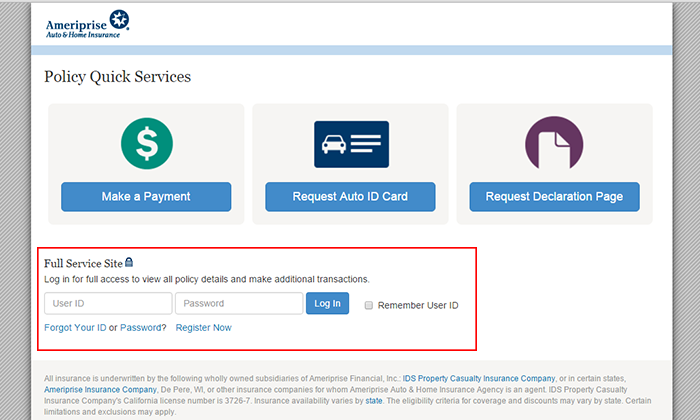

Step 1 – Go directly to the policy management page by pressing the ‘Login’ button at the top of this page.

Step 2 – Enter your user ID and password into the input fields (as seen in the below image), and click ‘Log In.’

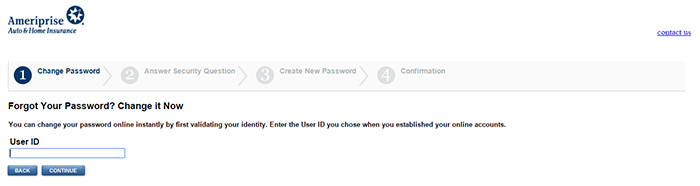

Forgot Password – On the sign-in page, click the ‘Password’ link directly under the input fields. You will be transferred to the four-step password reset form. In the first step, enter your user ID and then press ‘Continue.’ Answer the security question that you set up during the registration process. After successfully answering this question, you will be able to create a new password for your account.

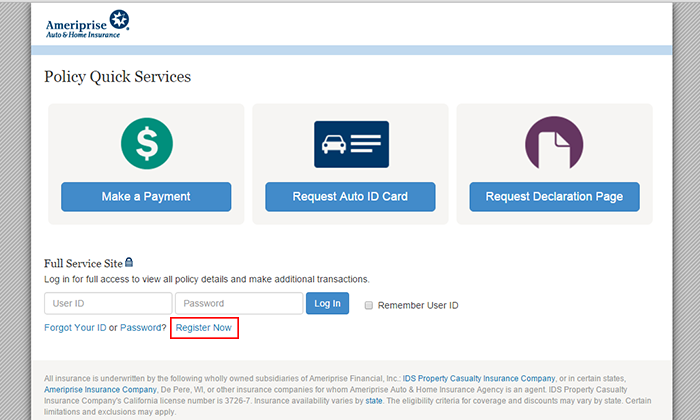

Enroll in Online Access

Step 1 – Go to the policy management page, and press the ‘Register Now’ link. You will be taken to the four-step account creation process.

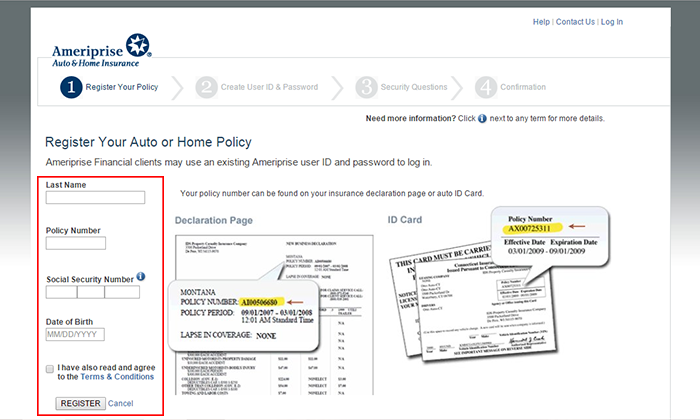

Step 2 – Enter your last name, policy number, social security number, and date of birth into the input fields. Check the box (agreeing to the terms & conditions), and then click the ‘Register’ button.

Step 3 – In the remaining steps (2-4), you will create your user ID/password, select account security questions (for identity verification purposes), and then finalize your account options.

Make a Claim

Step 1 – Home insurance claims should be reported by calling 1-800-872-5246. You should have the following information on-hand before calling:

- Policy number

- Police report (if applicable)

- Photos of damage

- Detailed description of incident

Note: An overview of the claims process (what to expect, detailed filing instructions, etc.) can be viewed on this page.