Policyholders can manage their Arbella account, make payments, file claims, and more via “MyArbella.” The guides below detail how to log in to the service, as well as how to create a new account. Auto, home, renters, and umbrella policies can all be registered online. Payments can be made over the phone, directly on the main website, or by logging in to MyArbella. More information regarding payment methods can be viewed under the “Payment” section on this page.

Arbella login

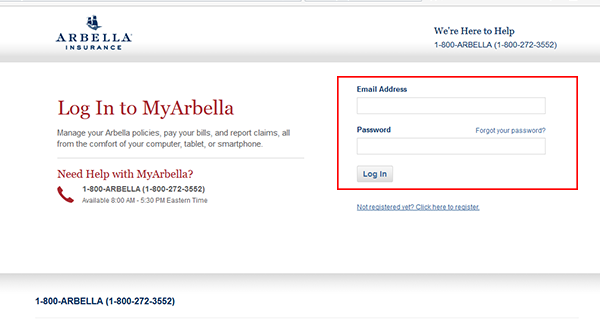

How to Log In

Step 1 – Click the login button at the top of this page (or go to http://www.myarbella.com).

Step 2 – Enter the email address associated with your account, and your account password into the input fields.

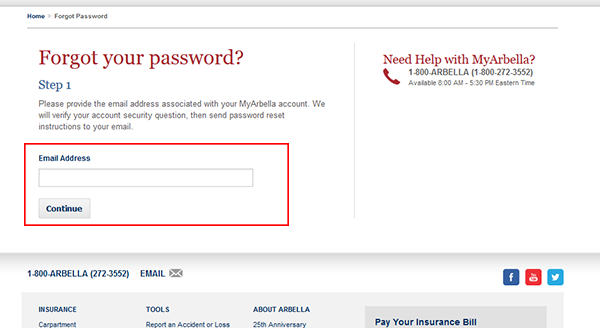

Forgot Password – If you forgot your account password, click the “Forgot Password?” link under the sign-in field. Enter your email address, and then hit “Continue.” After verifying your identity by answering the security question, a password reset link will be sent to your email address.

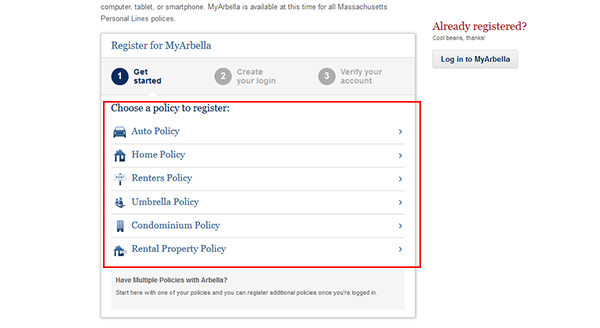

Enroll in Online Access

Step 1 – Press the “Not registered yet?” link under the sign-in form.

Step 2 – Select the type of policy that you want to register.

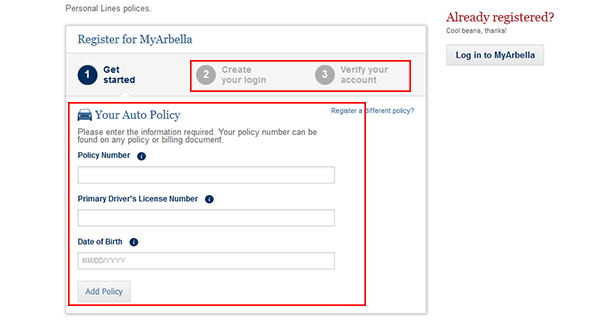

Step 3 – Enter your policy number, driver’s license (or other required information), and date of birth.

Step 4 – Create your sign-in credentials and then verify the account.

Make a Payment

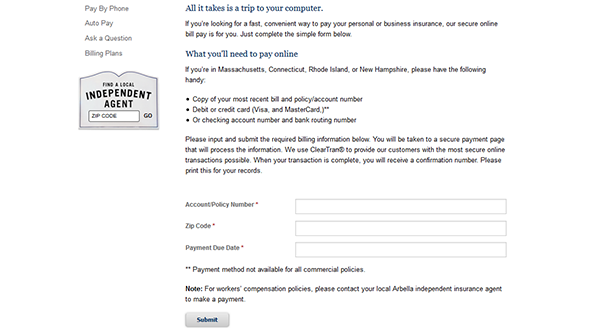

Step 1 – Payments can be made over the phone, online by signing in to your account, or by using the one-time payment form on this page.

File a Claim

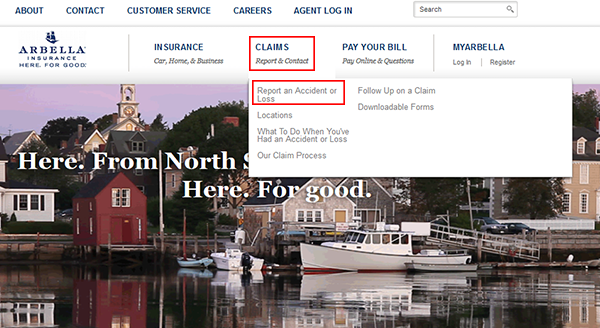

Step 1 – On the homepage, hover over the “Claims” link in the main menu and then click “Report Accident/Loss.”

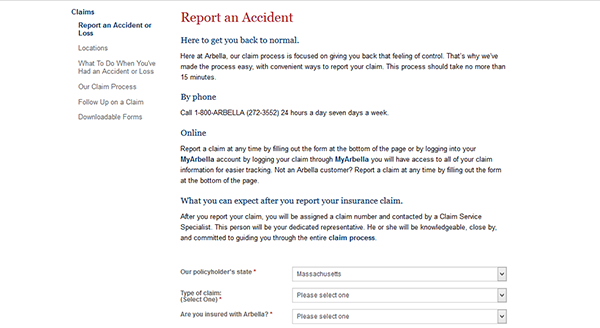

Step 2 – Report the loss/claim either by calling 1-800-ARBELLA, or by filling out the form on the claim page. You can also submit a claim by signing into your online account. After submitting your claim you will be contacted by a claims specialist.

Arbella Insurance Group Review

The Arbella Insurance Group is an insurance provider that was founded in 1988. The companyserves people that reside in New England states like Massachusetts and Connecticut and ontheir website they state “We’ve Got You Covered.” While personal insurance is available inMassachusetts and Connecticut business insurance is also offered by them in New Hampshireand Rhode Island. They offer auto, home, and business insurance at competitive prices and as acarrier they are a good option for people looking to bundle their insurance with auto andhomeowners’ policies.

Arbella has a reliable customer support service, provides hassle free claims, and offers a niceselection of discounts. Through myArbella there is self-service at your fingertips where you willfind the Arbella login to manage. Your policies and pay your premiums.

The type of insurance offered, by state, is:

Massachusetts (Personal Insurance)

- Car (motorcycle)

- Homeowners, Condo, and Dwelling Fire

- Umbrella

- Renters

Connecticut (Personal Insurance)

- Car (motorcycle)

- Homeowners, and Condo

- Renters

New Hampshire, Rhode Island, Massachusetts, and Connecticut (Business Insurance)

- Commercial Car

- Commercial Business Owners

- Commercial Umbrella

- Commercial Package Policy, Commercial General Liability, Commercial Property,Commercial Inland Marine

- Workers Compensation

Arbella Auto Insurance Prices

Arbella insurance has competitive prices that will depend on many things such as your drivingrecord, the make, model, your vehicle’s year, and your home’s security features. They are agreat option for business owners with their wide array of business insurances. On the mainArbella website, you can find an agent and receive a quote with your zip code and a few questions. Speaking of agents, you will also see an Arbella Agent Login link.

There is a Pay Your Bill link and by scrolling over that you will see the other links like:

- Pay Your Bill Online

- Pay By Phone

- Auto Pay

- Ask a Question

- Billing Plans

- How Arbella Protects Your Information

In the Billing Plans link they show all of the plans available for different types of insurance andhere is an example in Personal car insurance:

Payment Options: Auto Pay (No Installment fee) – Direct Mail ($4 – 6 installment fee)

Payment Plans

- Plan 1 – Auto Pay: 0% down and 12 monthly payments

- Plan 2 – 10% down and 9 monthly installments

- Plan 3 – 25% down and 3 monthly installments

- Plan 4 – 50% down and 1 monthly installment

- Plan 5 – 100% down and no monthly installment

There is a late payment fee of $15-25 and a $25-$30 return payment fee.

Types of Coverage that Arbella Offers

Here are the types of Arbella car insurance coverage:

- Liability – This is the backbone of auto insurance, as it helps pay for injuries anddamages when you are at fault in an accident.

- No-Fault (AKA personal injury protection PIP) – This pays for loss of income from anaccident as well as expenses for a funeral and a death.

- Physical Damage (AKA collision coverage) – This will help pay for the repairs, or thereplacement of your vehicle, if there are damages due to an accident or if it is stolen orsomeone vandalized it.

- Gap – Gap insurance will cover the difference that is still outstanding on an auto loan ifit is higher than the replacement value of a vehicle that is totaled.

- Disappearing Deductible – This decreases the amount of the deductible for each yearwithout an insurance claim.

- Accident Forgiveness – This will probably have a premium increase in the first autoaccident that you are in while insured at Arbella.

- Personal Property – This will help in costs to replace things that were damaged in yourvehicle because of an accident or were stolen.

- Pet Protection – You can receive veterinarian fees if you are in an accident and a dog orcat you own is injured

- Snowplow Insurance – This will help the costs of a lost snowplow that is installed on avehicle covered by Arbella.

- Original Equipment Manufacturer Parts (OEM) – Damages that are approved will befixed using original manufacturer parts.

The type of home insurance coverage is:

- Homeowners – Coverage for a house that you own as well as its contents for damagesfrom things such as fire, inclement weather, frozen pipes, smoke damage, and more.You can also be reimbursed if you need to stay somewhere while your home is beingrepaired.

- Renters – Coverage for contests where you rent.

- Condo – Just like homeowner’s coverage but for condos.

- Landlord – Covering damages to rental property that you own.

- Home Systems Protection – Coverage for various home systems.

Arbella Auto Insurance Discounts

Arbella has no lack of discounts for their policies. Here is the full list of discounts available, aswell as how much you can save, and some info on the discounts where you can save the most.

- New to Arbella (Up to 12%) – If you are a new customer and qualify.

- Good Student (Up to 5%)·Military Discount (Up to 10%) ·Pay Your Premium In Full (Up to 6%)

- Account Credit (Up to 13%) – If you have more than one personal Arbella insurancepolicy or one with another company that qualifies.

- Energy-Saving Hybrids or Electrics (Up to 10%)

- Multi-Vehicles – (Up to 2%)·Auto Loyalty Discount (Up to 1%)

- Anti-Theft Devices (Up to 36%) – You can really save if you have anti-theft devicesinstalled on your vehicle.

- Drive Less, Pay Less (Up to 10%)

- Student Away (Up to 10%) if a driver with less than six years of driving experience isaway at college or another educational institution over 100 miles from where thevehicle is kept.

- Driver Simulator Training (Up to 7%)

- Advanced Driver Training (Up to 5%)

- Motorcycle Training (Up to 10%) – Completing a motorcycle rider training course.

- Experienced Motorcycle Operator (Up to 25%) – Riders that are over 65 years old.

- Auto Rewards (Up to 25%) – Insuring your vehicle and home.

- Renew and Save (Up to 5%)

- New Home Credit (Up to 20%) – Discounts if you home is over 10 years old.

- MAHA Workshop Savings (Up to 10%)

- Protective Devices (NA)

- Rental Property – Account Credit (Up to 10%)

- New Business Discount (Up to 7%)

- Residence Safety Package (Up to 3%)

- Multi Car Family Discount (Up to 5%)

- ·Multi Car Individual/Spouse Discount (Up to 5%)

- Mass Save Discount (Up to 5%)

Arbella Insurance Pros and Cons

Here are the pros and cons for Arbella insurance:

Pros:

- Wide range of solid insurance coverage

- Great 24/7 customer service

- Easy payment options

- Many types of discounts

- Competitive prices

Cons:

- Only available in a few states

- Can have higher rates for some insurance products

Arbella insurance FAQ

How to use the Arbella pay bill option?

The Arbella pay bill option allows you to pay your premium online, over the phone, andautomatically. When you pay automatically, the money for the premium is taken directly fromyour checking or savings account. You can also mail in your Arbella car insurance payments toArbella Insurance Group, P.O. Box 55392, Boston, MA 02205-5392.

What is the Arbella insurance phone number?

The Arbella insurance phone number is 1-800-ARBELLA (272-3552). You can also contact themthrough the General Inquiries form and at their physical address at P.O. Box 699103 Quincy, MA02269-9103.

How to get a quote from Arbella insurance?

You can receive a quote over the phone or online through the Arbella website.

What does Arbella car insurance cover/include?

Arbella car and motorcycle coverage includes Liability, No-Fault, Physical Damage, GapCoverage, Disappearing Deductible, Accident Forgiveness, Personal Property, Pet Protection,Snowplow Insurance, and Original Equipment Manufacturer Parts (OEM).

What types of insurances does Arbella insurance offer?

Arbella mutual insurance offers personal and business insurance. They offer homeowners andauto insurance products and several business insurance products.

How do I file a claim with Arbella?

You can file a claim online and over the phone. You can see the updates on your claim through myArbella and there is a Claims link on the website. Also, from link you will see the other linksassociated with making a claim like:

- Report an Accident or Loss

- Locations

- What To Do When You’ve Had an Accident or Loss

- Our Claim Process

- Follow Up on a Claim

- Downloadable Forms

- Insurance Fraud

Summary

Overall, Arbella is a solid insurance carrier that offers auto insurance, home insurance, andbusiness insurance. It is not available in many states but they have reliable insurance products,competitive prices, great 24/7 customer support, and a solid reputation. They offer somecomprehensive business insurance products and one of the main advantages of using them isthe very wide array of discounts offered. You can do many things on the website, such as payfor premiums, purchase insurance, file a claim, and there is an Arbella insurance login for customers and also an Arbella agent login. Overall, the Arbella Insurance Group is a good choicefor many types of coverage.

Related Life Insurance Articles

- What is Life Insurance?

- Whole Life Insurance

- Term vs Whole Life Insurance

- LIRP: A Life Insurance Tax-Free Retirement Plan

- Colonial Penn Life Insurance 2023

- Life Insurance With Pre existing Conditions

- The importance of assigning a Beneficiary

- The Types of Life Insurance – Explained

Life Insurance Tips

- Is Life insurance a good career path?

- How to Start Selling Life Insurance

- How To Use Life Insurance While Alive