Globe life insurance policyholders can access and manage their policies 24/7 using the eService Center. Users can make payments, review policy details, view premium payments and update their mailing address. It is not clear what payment options are available for members. To find out this and more information about their products, send them an email here or call 1-800-654-5433.

Globe Life insurance login

How to Login

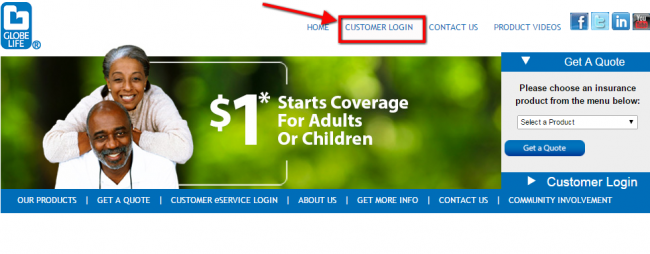

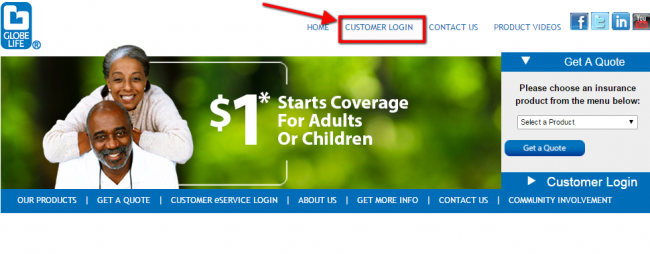

Step 1 – Visit the homepage of the website and click on ‘customer login’ at the top of the page.

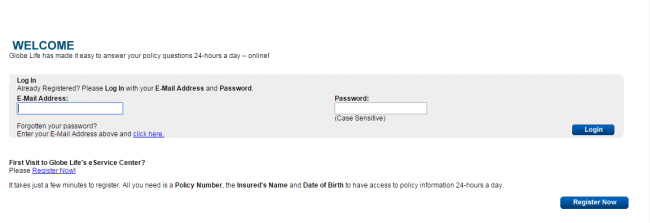

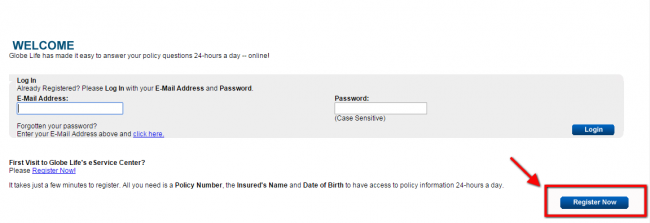

Step 2 – You will be redirected to the eService Center login page. Enter your email address and password then click ‘Login’.

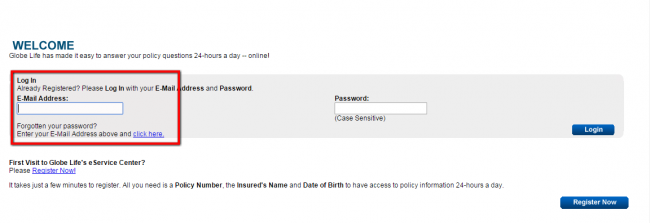

- Forgot Password – If you have forgotten your password, enter your email address on the eService Center login page and click on ‘click here’ just below the email field.

Enroll in Online Access

Step 1 – Go to the insurer’s website and click on ‘customer login’ at the top of the page.

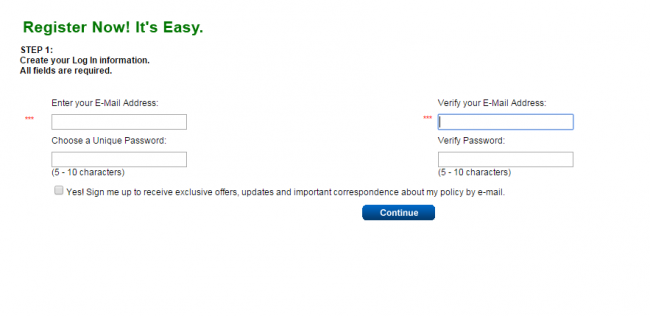

Step 2 – On the next page, click on ‘register now’ as shown below.

Step 3 – Create your login information. Enter your email and password then click ‘Continue’.

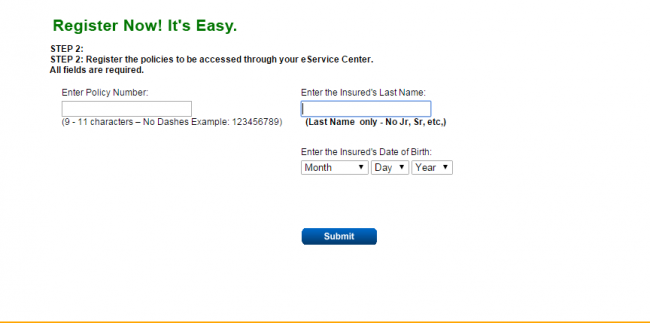

Step 4 – Enter your policy number, last name, and date of birth. Click ‘submit’ to complete the enrollment process.

Make a Claim

There is not much information on the company’s website about filing a claim. However, customers can call customer service toll-free at 1-844-875-7684 to find out how to go about it. While the company does have an online policy management service dubbed eService, it is also not clear whether claims can be filed through it.

Globe Life Insurance Review

Globe Life is an insurance carrier that offers solid life insurance to their customers. Established in 1900, the company has been around a while. Their main goal is to help people secure their financial future. They offer policies for both adults and children and a very wide range of benefits for accidental deaths.

The life insurance and supplemental health insurance are easy to get, as there is no medical exam needed and they have a yes/no application. On the Globe Life website they state, “You and your family will always be our highest priority.” The company can be reached 24/7 by phone, online, and you can schedule an appointment with an agent. The insurance products offered are for a competitive price and you can purchase policies over the phone, online, or by snail mail. On the site there is a Globe Life insurance policy login link where you can manage your policy/policies and make payments for premiums.

Types of Coverage that Globe Life Insurance Offers

The types of coverage that Globe Life insurance offers are in the categories of Life Insurance, Supplemental Health, and Children’s Life.

Life insurance Products:

- Term Life Insurance

- Whole Life Insurance

- Final Expense Insurance

- Accidental Death Insurance

- Mortgage Protection Insurance

Supplemental Health Products:

- Cancer Insurance

- ICU Insurance

- Critical Illness Insurance

- Hospital Insurance

- Accident Insurance

Children’s Life Product:

- Children’s Life Insurance

Both policies for term insurance and whole life insurance are seen as insurance for final expenses and that means that the payouts that are more limited are more advantageous for covering costs for end-of-life rather than replacing income.

There is no medical examination needed for whole life insurance with a simple application. However, there will be health questions that you are required to answer and considering there is limited underwriting the benefits for death are also limited as well. However, this can be solid coverage for final expenses. Typically, the costs of a funereal will be around $10,000 and the company gives payouts from $5,000-$50,000 and usually they will come in increments of $10,000. For the death benefit the cash value is not added. However, it will increase with a rate that is guaranteed over time. You have the choice to borrow money against the policy you have or fully give it up.

For the Globe Life term insurance there is also no medical examination needed and there are not many death benefits. You have the option to buy term insurance for:

- $5,000

- $10,000

- $20,000

- $30,000

- $50,000

- $100,000

Globe Life states that they have premiums that are level for the policy’s full term, so the coverage is only for five years. The policyholders are placed in a 5-year age bracket and when the first term comes to an end you will move up in the age bracket and each time you renew the policy you will pay more for the premiums.

The accidental death insurance benefit is up to $250,000. It will go up 5% annually in the policy’s initial five years or until you turn 70 years old whatever comes first. If you are between 18 and 69 years of age you are guaranteed to receive accidental death insurance. This type of coverage pays a claim that is in the set definition of accidental death, so a car crash or motorcycle accident would fall under these parameters while death from sickness or long illness, like cancer, would not.

There are additional payout opportunities depending on the way that you pass away, which are:

- A parent’s accidental death

- Accidental death while being in a vehicle

- Accidental death being a passenger on a commercial airline

- Suffering paralysis

- Suffering dismemberment

Globe Life Insurance Prices

As stated before Globe Life insurance offers competitive prices for their insurance products. The healthier you are the less you will pay in premiums. The cost will also depend on the coverage that you want and if you want to add things to your policy. They are one of the better companies when it comes to affordable insurance options without having to go through a medical examination. On the website you can receive a quote and through the Global Life login you can retrieve a saved quote.

Globe Life Insurance Pros and Cons

Pros

- No medical exam needed, so very easy to get insurance

- Rates are reduced for first month of policy

- Reputable name in the insurance industry

- Several additional benefits for accidental death insurance depending how the death happened.

- Reliable customer service

- Mobile application available

- Unique Global Life eservice

- Globe Life Insurance pays online

Cons

- No home or auto insurance available

- Maximum benefits are on the lower side

- Minimum coverage amount of $5,000

FAQ’s

What is the Customer Service Department Like at Globe life insurance?

Globe Life has solid 24/7 customer service and you can get in touch with them via email, phone, and snail mail. The customer service phone number is 1-866-298-9115 and on the main page there is a link for Get Info By Mail where you can request a quote or any other information by inputting that information and your address and that info will be sent to you. The physical address of the company is 3700 S. Stonebridge Drive, McKinney, TX 75070. There is also the Globe Life eservice center where after you input your info through the Globe Life eservice login you can get information about your policy or have any question answered 24/7 online. The customer service email address is [email protected].

How to Cancel Globe Life Insurance?

You can cancel your policy by phone by:

- Calling 1-877-577-3860

- Request to talk with an agent

- Request the cancellation of policy

There is also a 30-day money back guarantee if you are not happy with your policy and cancel within the first 30 days.

How to File a Claim with Globe Life Insurance?

You can file a claim through Global Life insurance by phone or e-mail. The claims e-mail address is [email protected] and the claims phone number is 1-800-654-5433. The hours of operation for phone service for claims are 7:30 a.m. to 6:00 p.m. CST, Monday – Friday.

Is Globe Life Insurance Financially Stable?

Yes. A few reputable agencies that give ratings for insurance carriers have given Global Life insurance some great ratings such as:

- S&P rating of AA-

- Fitch Rating of A+

- A.M. Best A+

You can also tell the company is financially stable as there are over 4 million policyholders and the Better Business Bureau has accredited the company since 1952.

How Can I Pay My Globe Life Insurance Premiums?

There are a few ways to make a Globe Life insurance payment, which are:

- Bank Draft – you can set up Global Life bill pay to have automatic payments from your bank account.

- Online – Through Globe Life e-service you can use the Globe Life billing login link to pay your bill.

- Phone – You can make a Globe Life payment by calling the phone number of 800-831-1200. Mail – You can send your payment to the physical address of PO Box 653032, Dallas, TX 75265-3032.

What Can I Do with the Globe Life Insurance App?

The Globe Life insurance app is free to download for Android and iOS users at Google Play and the Apple App store. With the app you can:

- Pay your premium bill per month

- Accept options for additional insurance when you are eligible

- Set up an option for one-time payments

- Update personal information

- Find more information on options for coverage

- Follow Globe Life insurance on social media

Can I Cash Out My Globe Life Insurance?

The only insurance that has a cash value is whole life policies. This increases over time and can be paid out if you make the decision to cancel the policy. You cannot cash out policies for term life and accidental death.

Is There a Grace Period for Unpaid Premiums?

Yes. If you do not pay a premium there is a lapse in coverage and because of this, you may lose all of the coverage. However, most of the policies offered have a 31-day grace period for you to catch up. There are also other options where Globe Life will work with you if you are having payment issues.

Summary

Globe Life insurance is a carrier that has a solid reputation and has been offering life insurance products since 1900. The company is financially stable and offers an array of life insurance policies such as term, whole, and accidental death. They have competitive prices for their products and it is quick and easy to receive a quote as well as make a claim. There is great customer service available and a ton of useful information on the Globe Life website where you can use the Globe Life login and manage your policy or policies. There are also quite a few things you can add to the policies for increased benefits.

Related Life Insurance Articles

- What is Life Insurance?

- Whole Life Insurance

- Term vs Whole Life Insurance

- LIRP: A Life Insurance Tax-Free Retirement Plan

- Colonial Penn Life Insurance 2023

Life Insurance Tips

- Is Life insurance a good career path?

- How to Start Selling Life Insurance

- How To Use Life Insurance While Alive