Infinity Auto Insurance Login

If you are a current Infinity auto insurance policyholder and have already registered your online account, you can make monthly premium payments (both recurring and one-time) by signing in to your account via the website/mobile app (download the iOS/Android app to your device via the links at the top of this page). Use the guides below to learn how to access your account from the website, recover a lost password, and make a claim.

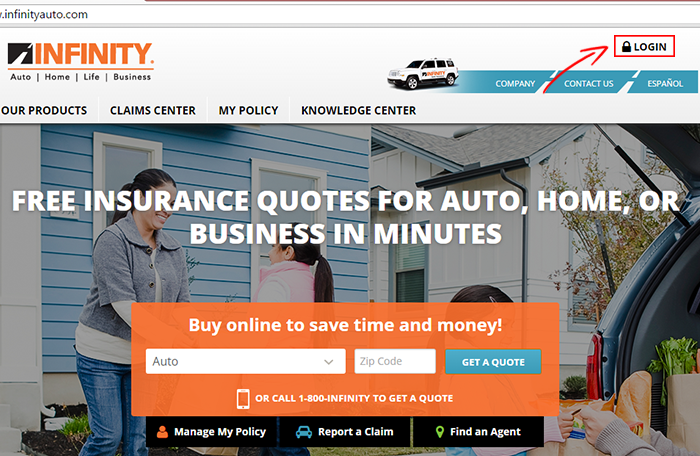

How to Log In

Step 1 – Starting on the homepage (www.infinityauto.com), click the ‘Login’ button at the top of the page (outlined in the image below).

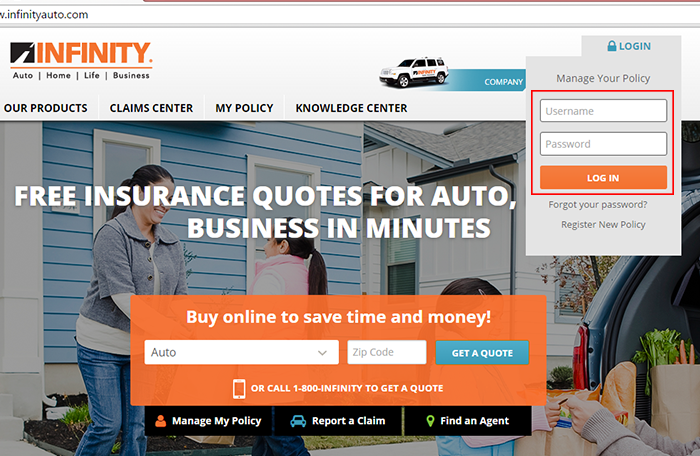

Step 2 – Enter your username and password into the input fields. Click the ‘Log In’ button.

Note: You might be required to verify your identity during the sign-in process.

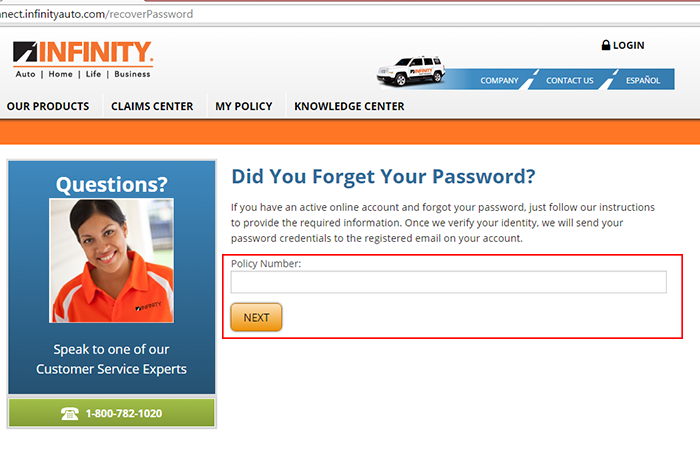

Forgot Password – If you do not remember your account’s password, click the ‘Forgot Your Password’ link under the sign-in form. On the next page, enter your policy number and click the ‘Next’ link. Continue following the on-screen instructions to recover/reset your password.

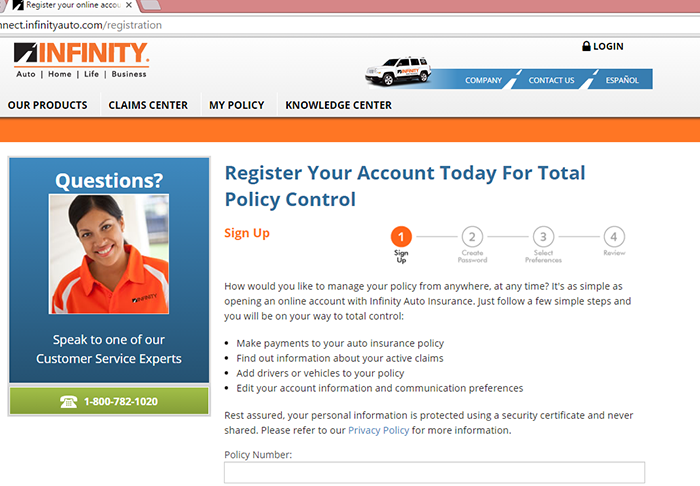

Enroll in Online Access

Step 1 – Go to the registration page here.

Note: You can also get to the registration page by clicking the ‘Register New Policy’ link under the sign-in form.

Step 2 – The registration form is four-steps long. In the first section, enter your policy number, driver’s license number, and date of birth. Press ‘Next’ to move on to the next step (password creation). Follow the on-screen instructions to create your account.

Make a Claim

Step 1 – There is currently no online claim reporting tool. All claims should be reported by calling 1(800)-334-1661. Go to this page for detailed information regarding the claims process.

Note: You should file a claim as soon as possible in order to quicken processing/response times. If you have already reported a claim, you can view the status of it by signing in to your account.

Reviews About Infinity Auto Insurance

Infinity Auto Insurance is owned by Kemper, a nonstandard insurer. If you live in either Arizona, California, Florida, Georgia, or Texas, you have access to Infinity auto insurance. Infinity also offers commercial auto policies and a variety of other options. Infinity specializes in providing high-risk drivers with auto insurance, as well as providing a large list of insurance products offered through third-party insurers.

According to Infinity’s website, it primarily serves the Latino communities in areas like Miami and Los Angeles, so it makes sense why the website is also available in Spanish. For anyone struggling with finding auto insurance at a good price, Infinity may be your best bet. Especially if you have bad credit or struggle to obtain car insurance.

Infinity Insurance Company as a Whole

If you are looking for car insurance, Infinity car insurance is one of your best options. Whether you are simply looking to cover one car or other insurance needs, there are many levels of coverage and options to choose from. Look through the many options below to decide for yourself.

Car Insurance

Infinity Insurance offers a few different car insurance policy options. These vary based on protection, and the ability to customize your own policy. This should be done based on your budget and needs. If you have a poor driving record, or you have never obtained insurance previously, then you are considered a “high-risk driver.” Infinity offers affordable rates on basic coverage for the following:

- Liability

- Medical payments

- Uninsured/underinsured motorist

- Collision

- Comprehensive

Motorcycle Insurance

If you love riding a motorcycle, then you need to be covered in case of an accident. When it comes to motorcycle insurance you need to have coverage that works with your needs, and also covers your bike.

There are many types of bikes that require motorcycle insurance such as scooters, trikes, touring bikes, and other two-wheeled vehicles. The coverage from Infinity Insurance includes motorcycle options such as:

- Bodily injury liability

- Property damage liability

- Medical payments

- Personal injury protection (PIP)

- Uninsured/underinsured motorist

- Collision

- Comprehensive

- Insurance for accessories, including sidecars

Classic Car Insurance

Classic cars are exciting and unique. If you are someone who owns a classic car you might know how difficult this makes finding insurance. Having an antique car, modified car, or an exotic car is also under the umbrella term of “classic car insurance.” The only restriction on classic car insurance from Infinity is that your commute to and from work will not be covered.

The total Infinity protection package for classic cars include:

- Agreed value coverage: If you total your car, this coverage pays the amount listed in your policy regardless of depreciation.

- Drive-to-work coverage: For those who use their vehicle in their commute, this coverage covers you for up to 30 days during the term of your policy and up to five consecutive days in any 14 day period.

- Spare parts coverage: This coverage offers up to $1,000 for parts stolen or damaged. It does not cover vehicle breakdown.

- Trip interruption: Should your vehicle break down over 50 miles from home you will be given $75 per day or $500 per incident to cover costs for lodging and transportation expenses.

- Newly acquired vehicle coverage: If you add a new classic car to your collection you may be covered for up to $75,000 for 30 days.

- Full glass coverage: In case your windshield or other car glass is broken, you will be completely covered.

- Emergency roadside assistance: Covers up to $100 for either towing or labor expenses. This is essential should you break down suddenly.

ATV Insurance

Infinity offers insurance for more than just your standard card, but also a variety of all-terrain vehicles such as ATVs. Whether you ride for fun, or for work in your yard, Infinity can cover you for a variety of needs:

- Liability for bodily injury insurance

- Property damage liability insurance

- Collision

- Comprehensive

RV Insurance

If you enjoy taking out a recreational vehicle, or if you reside in a recreational vehicle, then you will need to have RV insurance. This includes motor homes, motor coaches, camper vans, and travel trailers. No RV situation is the same. Whether you live in your RV, or simply enjoy taking it out for a vacation, either way you have the choice from a variety of different Infinity coverage options. These include:

- Bodily injury liability

- Property damage liability

- Medical payments

- Uninsured/underinsured motorist

Commercial Insurance

Infinity not only offers standard car insurance but also provides commercial car insurance as well. Whether you need coverage for full-size vans, pick-ups and utility trailers, cargo vans, or any other work vehicle.

Infinity makes it easier to obtain insurance at a good rate, especially if you are hiring young drivers, those with foreign driver’s licenses, or individuals with questionable records. There are various benefits from choosing Infinity for commercial insurance including automatic coverage for eligible new hire employees.

To qualify for an Infinity commercial auto insurance policy, you must be one of the following:

- Small- to medium-sized business with commercial drivers

- Business with cars used for business purposes, such as transportation of cargo material

- New venture with up to 20 vehicles

Mobile Home Insurance

Whether you are living in a standard mobile home or manufactured home, Infinity offers insurance policies that include coverage for:

- Personal liability

- Personal property

- Dwelling structure

Infinity Auto Insurance Discounts

Known as a reliable company, Infinity car insurance offers a number of auto discounts. Although these vary by state, you may have the opportunity to take advantage of discounts. These discounts are based on the following:

- Multiple cars

- Loyalty

- Safe driver

- Discount for getting a quote at least six days before your current policy ends

- Paid in full

- Paperless

- Discount for starting your quote online

- Vehicle safety

- Mature driver improvement course

- Good student

- Switch and save for new customers

- Homeowner

- AAA member

Features and Services

Infinity is known for offering great customer service. If you are a high-risk driver, then it may be the best option for you. If you are looking for affordable rates, flexible payment plans, or competitive down payments, then Infinity might be the right choice for you.

Another great part of using Infinity as your insurance agent is that through your Infinity auto insurance login or Infinity car insurance login you can access a free DriverClub® membership. This provides the opportunity to make Infinity insurance claims, access support, and roadside assistance 24 hours per day, 7 days per week. The mobile app also allows you to find repair shops, and make payments.

Infinity Insurance Login

If you are looking to process your Infinity auto login to pay your bill, or for another purpose, simply go to InfinityAuto.com and type in your Infinity insurance sign in.

In order to serve you better, Infinity has an online self-service center that will allow you to manage your policy. This center also allows you to use your Infinity auto insurance login to select payment options and make online payments. These online features can be accessed from your computer, tablet, or smartphone at any time.

When going through the process of your Infinity auto login, you may wonder about your security. Infinity keeps your data private. This means that credit card numbers and personal details always stay encrypted. You can refer to the Infinity privacy policy for more information regarding the Infinity car insurance login security.

Infinity Insurance Payment Methods

When it comes to infinity auto insurance payment methods you really only have two choices, and both are to make an infinity insurance payment online.

- Mobile app payments

- Online payments

If you are attempting to go to infinity insurance make a payment section, simply click on “infinity pay my bill”. In this instance, you will be able to Infinity make a payment. This should be easy to do.

Infinity Insurance Reviews From Real Customers

“I recently changed insurance companies because I moved to a new state and my insurance rate increased by $20 a month, so I figured it was a great time to shop around and see what my options were. I have to say, I’m more than pleased with my choice at infinity auto insurance. I was also informed of what to do if I needed to file a claim on my insurance for either car and I was also informed of what my deductible would be. I also was told that after my first initial 6 months my policy would go down

I am a satisfied customer and have had no issues when it comes to renewing my insurance every year since I have signed up with Infinity Auto Insurance.”

Contacting Infinity Insurance

If you are looking to contact Infinity Insurance, you can reach them at 1-800-INFINITY. Customer service representatives will be able to answer your questions directly from the customer support page as well. Be sure to have your Infinity insurance number ready to make the process move as quickly as possible for both you and the representative you talk to.

FAQ

What features does Infinity Insurance offer?

Infinity insurance offers many incredible features to help you make the most out of your insurance policy. Some of these features include the options like:

- 24/7 service

- Mobile app for iPhone and Android

- Roadside assistance

- Coverage and low prices for high-risk drivers

- Online account management

Does Infinity offer SR-22 insurance?

If you have received a DUI for driving under the influence then you will be required to have an SR-22 form to obtain insurance. Infinity Insurances offers SR-22 insurance for a variety of states. This includes California, Nevada, Texas, Arkansas, Alabama, Georgia, Pennsylvania.

Who are the top 5 insurance companies?

There are a few top insurance companies to choose from when picking car or auto insurance. Despite this, it’s good to note that you may not qualify for all based on your driving record and insurance record.

- Infinity Auto Insurance

- State Farm

- Progressive

- Metromile

- Geico

How to get a hold of Infinity Insurance Claims?

If you are looking to get a hold of the Infinity Insurance claims center, you can call the Infinity insurance phone number at 1-800-INFINITY. You will be redirected to the First Notice of Loss (FNOL) adjuster. This adjuster will ask you some basic questions, including your Infinity insurance number.

What does full coverage Infinity cover?

Full coverage is defined as a variety of coverage options consisting of both comprehensive and collision insurance. This also includes whatever insurance that is required by the state. Essentially, full coverage means that every range of coverage and limits are applied to a vehicle’s policy.

What should I expect from Infinity Insurance Customer Service?

The helpful online platform from Infinity Insurance is easy to use, and customer service is available 24 hours a day. It is also available in English and Spanish, through either by phone call or online chat. These numerous options make it easy to get help when you need it.

Does Infinity Insurance have a cancellation fee?

Although some customers do report a cancellation fee, Infinity does not have a specific cancellation fee. This will vary based on your specific plan. You can call 1-800-INFINITY to find out if you will be required to pay a cancellation fee.

Does Infinity Insurance have a grace period?

You will have a 15 day grace period if your payment is not received by your due date. At this point, you will receive another payment request. If you do not make this payment by midnight on the last day of that grace period, your policy will be canceled.

Is Infinity Insurance a standard company?

Infinity Auto Insurance Company is a non-standard auto insurance provider. This means that Infinity offers policies to consumers through independent agencies and brokers. This allows Infinity Insurance to provide policies to those who may otherwise not be able to obtain affordable car insurance.

Who is Infinity Insurance best for?

If you need accessible auto insurance then Infinity is right for you, especially if you would consider yourself a high-risk driver. High-risk drivers are more likely to file an insurance claim. This means you may have a history of car accidents, multiple tickets, bad credit, or a conviction for a DUI.

Is Infinity Insurance a good car insurance company?

Infinity Auto Insurance is one of the most affordable and accessible car insurance options on the market. With reliable customer service and easily accessible online policies, you can expect an affordable policy regardless of your credit, car insurance, or driving history.