Register for the Molina Insurance “ePortal” to view your policy/plan details, request/track service changes, change your primary care provider, make a payment, request a new ID card (or print a temporary card), update your contact/policy details, etc. The instructions in the various sections posted below go over how to register a new account, how to sign in, and how to reset your password (if you forgot it).

Molina login

How to Log In

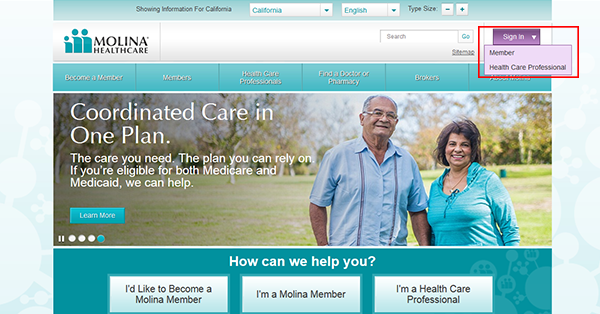

Step 1 – Access the main login/member portal page by going to the homepage () and then clicking the “Sign In” button (Sign In > Member).

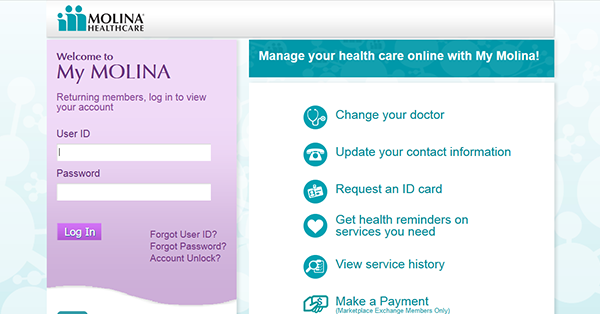

Step 2 – Once on the “MyMolina” page enter your user credentials (user ID/password) into the form and the hit the log in button to access your account.

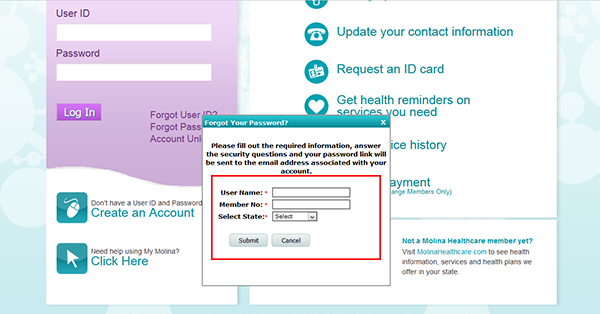

Forgot Password – Hit the “Forgot Password?” link on the member portal page. Enter your username, member number, and state of residence into the pop-up form. Click the submit button, and then continue to follow the given instructions in order to reset your password.

Enroll in Online Access

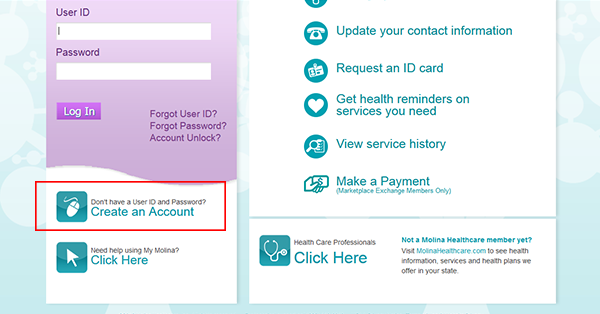

Step 1 – Go to the “MyMolina” page and press the “Create an Account” link (located underneath the sign-in form).

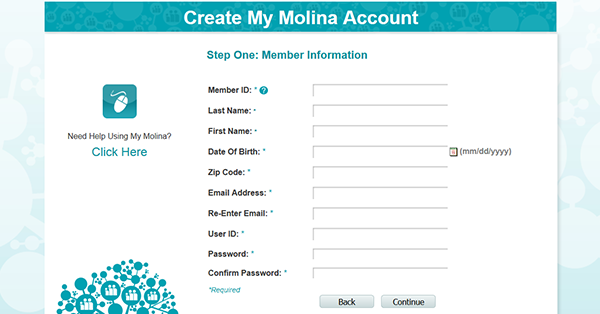

Step 2 – Enter the following details into the input fields:

- Member ID

- Last name

- First name

- Date of birth

- ZIP code

- Email address

- User ID (create one)

- Password (create one)

Step 3 – Click the continue button. Follow the on-screen instructions to complete the registration process.

Note: Once you’re signed up for online access you will be able to make online payments by signing in to your account. The online payment service is only available to Marketplace Exchange members.

Molina Insurance Review

Molina insurance was established as a clinic in 1980 in California by ER C. David Molina and he started his own clinic to help low-income families. He started the clinic, as he saw too many low-income patients come into the emergency room for care that was routine in nature. The company grew over the years and in 1997 the company expanded outside of California and Molina insurance went public in 2003. It is a financially stable insurance carrier with annual revenue that is around $20 billion and in late 2020 Molina insurance was a Fortune 500 company. They offer solid healthcare options at an affordable price.

Molina insurance is available in the states of:

- California

- Florida

- Idaho

- Kentucky

- Illinois

- Louisiana

- Maine

- Michigan

- Mississippi

- New Jersey

- New Mexico

- New York

- Ohio

- South Carolina

- Texas

- Utah

- West Virginia

- Washington

- Wisconsin

Molina specializes in offering their healthcare plans for:

- Low-income families

- Pregnant women and others that are on the Medicaid plan

- Children in the State Children’s Health Insurance Program (SCHIP)

- Low-income senior citizens that are a part of the Medicare Advantage health plans

- Dual plans for Medicare and Medicaid

- People that need prescription drugs

On the Molina website you can manage your policy as well as make payments to your premiums.

Types of Coverage Molina Insurance Offers

Molina health insurance offers health plans that are comprehensive and give people solid benefits as well as programs at an affordable price. The Molina insurance plans offered are:

- Medicaid

- Molina Medicare

- Dual Integrated Medicaid and Medicare

- Molina Marketplace

Medicaid

Molina health insurance has contracts with the governments of the states it offers its plans. It gives customers a large range of solid healthcare services to both families and people that are qualified for programs that are sponsored by the state including Medicaid and SCHIP.

Molina Medicare

There are the Medicare Advantage healthcare plans available that are tailored to fit the specific needs of people that have Medicare coverage as well as dual Medicaid and Medicare. The Medicare plans are comprehensive ones that offer many benefits, as well as healthcare programs. The plans give people in it access to many doctors, clinics, hospitals, and providers of health care and offer them a cost that is out-of-pocket that is very little and oftentimes there is no out-of-pocket costs, which is great for low-income families and individuals.

Dual Integrated Medicaid and Medicare

There are several dual Integrated Medicaid and Medicare demo projects for a healthcare approach for those that qualify for Medicaid and Medicare. Molina health insurance has worked with them for many years with the Medicaid health care programs and Medicare health care programs. The years of experience Molina has in these partnerships helps them offer solid health care that is tailored to fit their specific needs.

Molina Marketplace

Marketplace is also referred to as Exchange in some states and the plans are offered in states where Molina has their Medicaid healthcare plans available. The plans offered by Molina insurance lets their customers continue with the providers they use at the time when they transition to the plans from Medicaid to Marketplace. Also, Molina does away with financial roadblocks to getting solid healthcare by making out-of-pocket expenses for their customers very small.

In the Molina insurance plans they offer:

- Primary Care – This is healthcare the way you want it as you can take advantage of the benefits of wellness checkups on a yearly basis as well as other virtual healthcare services.

- Preventive Care – There are many preventive care services available to Molina insurance customers, where they can take preventive measures in order to stay healthy.

- Pediatric Care – You can use Molina insurance to cover pediatric vision issues as well as pediatric dental coverage for things such as teeth cleaning and fillings.

Molina Insurance Prices

The prices for Molina health insurance are very affordable, as the company was founded to specifically help low-income families and individuals with their healthcare needs. The company focuses on people that qualify for government healthcare programs and because of this the prices are low and on top of that there are little if any out-of-pocket expenses.

Other factors that go into the prices for Molina insurance are:

- Age

- If you are a smoker

- Where you live

- The plan that you want to purchase

To get more pricing information from Molina insurance you can contact them through the my Molina login on their website and you can also call the Molina insurance phone number at (800) 869-7165. You can also get pricing information by calling the state office and you can find all of those numbers here.

Molina Insurance Discounts

Molina insurance has discounted health insurance options for families and individuals that qualify for government run health programs. If you are eligible for such programs, you can receive discounted health plan coverage. The discounts available will depend on where you live as well as other things such if you are a smoker and your age. Molina insurance will work with you to get the best price available for the healthcare coverage that you need.

Molina Insurance Pros and Cons

Pros

- Great for low-income families

- Great for low-income individuals

- Contracted with government run healthcare programs

- Great customer service

- Customer service online and by phone available in English and Spanish

- Wide range of services offered in the plans

- Easy to get a quote

Cons

- Not available in every state

- Not many plans aside from government run ones

- Not many discounts despite being a low-cost insurance option

FAQ

How to check if my Molina insurance is active?

Through the 24/7 online portal, you can use my Molina account login to check if your Molina insurance is active. You can also call the main phone number as well as the state numbers to get this information as well. Through the online portal you can also:

- Print out a temporary Molina insurance Member ID card.

- Ask for a new card if you need one.

- Change the provider that you use.

- Check if you are eligible for plans.

- Update the contact information you have with the company.

- Get automatic reminders of various healthcare services that you may need.

What type of insurance is Molina healthcare?

Molina is a type of healthcare that is contracted with government run healthcare programs. This helps people that are eligible get the best health care possible at the lowest price.

Where is the group number on Molina’s insurance card?

The group number can be seen on the upper left side of your Molina insurance card that will be mailed to you when you become a member. After you get the card make sure that it has all the information of:

- Your full name

- Member ID number

- The name of your primary care doctor

- Your primary care doctor phone number (office number)

- The phone number for the Molina Healthcare’s 24-hour Nurse Advice Line (in English and Spanish)

- Toll-free for prescription drug related inquiries (for the prescription benefit for Molina Healthcare)

- Toll-free number for hospitals that can get in touch with Molina for admission to Molina plan members.

What are Molina insurance working hours?

The working hours for the Molina health insurance headquarters located in Long Beach, California are 8 AM PST to 6 PM PST. The working hours for the other state offices will differ.

Can I make a payment online with Molina?

Yes. You can pay online by logging into mymolina.com payment login.

How to use Molina payment?

For Molina payment you can use:

- Your Molina login

- Register for automatic payment

- Click the link of Pay Now for a Fast and secure one-time payment

- Make Molina payment online by Bill Pay logging on to your bank’s webpage

- Molina pay my bill by mail at Molina Healthcare, PO Box 75159, Chicago, Illinois 60675-5159

- Pay by MoneyGram

- Pay by phone at (888) 858-2150

What is the Molina insurance phone number?

The Molina insurance phone number is (800) 869-7165 and you can view all of the phone numbers for the state offices here.

Summary

Molina health insurance is a provider that offers insurance coverage and they specialize in giving solid coverage options to low-income families and individuals. They work with government run healthcare programs to help give people the coverage they need at a price they can afford. The company was established in 1980 and since 2020 they have been on the Forbes 500 list. Because of this you know they are a financially stable provider and they have over 4 million members across the United States.

Through my Molina account on the website you can manage your policy and make payments. The company has received very good Molina insurance reviews and there are many options for you to make payments. The company has great customer service that is available in English and Spanish and they will work with you to get the best coverage at the best possible price.