There are numerous benefits to registering a Mutual of Omaha Life Insurance policy online. Once you’re signed up for online access you will be able to view your account summary, policy benefits/coverages, review claims, pay bills, and print out ID cards. Follow the instructions below to learn how to create and access your online account.

Mutual of Omaha login

How to Log In

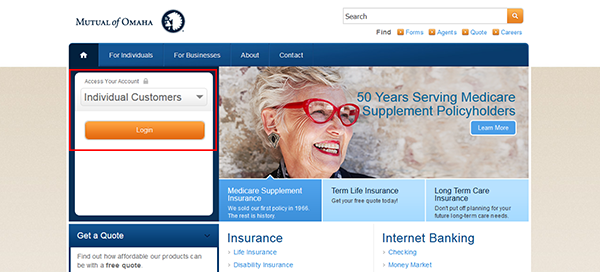

Step 1 – Start by going to the homepage (http://www.mutualofomaha.com/).

Step 2 – Press the login button to go to the main login page.

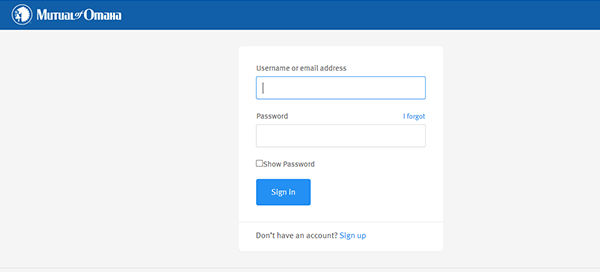

Step 3 – Enter your username/email address and password.

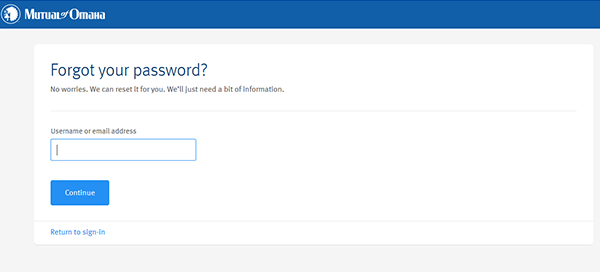

Forgot Username/Password – Click the “I Forgot” link on the sign-in page. Enter your username/email address. After verifying your identity you’ll be able to reset the password.

Enroll in Online Access

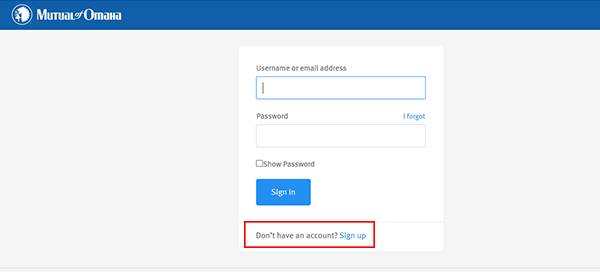

Step 1 – Go to the main login page and then press the “Sign Up” link.

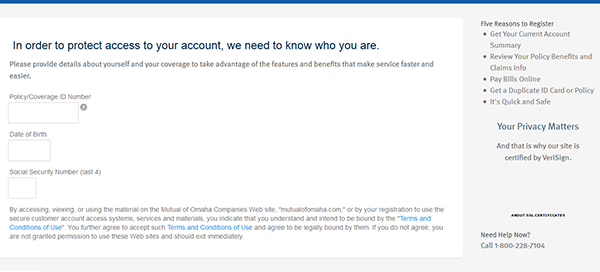

Step 2 – Fill in your policy/coverage ID number, date of birth, and last four digits of your social security number. Press the continue button.

Step 3 – Create your username/password.

File a Claim

Step 1 – Call the life policy claim line at 888-493-6902. If the policy you need to file a claim for was purchased through an agent, contact that agent.

Make a Payment

Step 1 – Payments can be made online by logging into your account. You can also arrange payments through your agent.

Mutual of Omaha Life Insurance Company Review

Mutual of Omaha began in 1909 as Mutual Benefit Health & Accident Association and changed its name to Mutual of Omaha Insurance Company in 1950. It was founded by Dr. C.C. and his wife, Mabel Criss while Dr. C.C. was a medical student at Creighton University in Omaha. It offers a broad portfolio of life insurance products, medicare supplement insurance, and employer-based plans. Its home office remains in Omaha, Nebraska. Mutual of Omaha is a Fortune 500 company with over a century of commitment to helping customers through their life journey by providing expert advice and quality products through every stage of life.

Types of Plans Offered by Mutual of Omaha Life

The life insurance plans offered by Mutual of Omaha fall into three distinct types of life insurance plans: Term Life, Whole Life, and Universal Life.

- Term Life Insurance – Term life insurance policies are designed to provide a fixed death benefit for a set amount of time for a fixed premium. The term life options through Mutual of Omaha are Term Life Answers and Term Life Express, which offers a simplified issue process. Both policies have similar features including term periods of 10,15,20, and 30 years, guaranteed level premiums, and coverage amount starting at $100,000. Optional riders include waiver of premium, waiver or premium for unemployment, children’s rider, accidental death benefit, and other insured riders.

- Whole Life Insurance – Whole life insurance policies provide a fixed death benefit and a set premium for the entirety of an individual’s life. Guaranteed Issue and Living Promise are the two Whole Life policies offered by Mutual of Omaha. Both policies have fixed death benefits and guaranteed level premiums. Coverage is available starting at $2,000 ($5,000 Washington State) and maxes out at $25,000 for the Guaranteed Issue policy and $40,000 for the Living Promise policy. Both policies feature accessible tax-deferred cash value. Riders available for the Living Promise policy include accelerated death benefit for terminal illness and accidental death benefit. The Guaranteed Issue policy does not have any available riders. Additional benefits include a graded death benefit, no medical exams, or health questionnaire for the Guaranteed Issue policy. The Living Promise policy offers simplified underwriting.

- Universal Life – Universal life insurance policies are a type of policy that offers flexible coverage, frequency of payments, and amount of premium. Mutual of Omaha offers four Universal Life policies: Life Protection Advantage SM, Income Advantage SM, Guaranteed Universal Life, and AccumUl Answers. Similarities between these policies include lifetime terms and coverage ranging from $100,000 to over $1 million, no age restrictions, tax-free death benefit, tax-deferred cash value, flexible death benefit, flexible premiums, and flexible premium frequency. The Income Advantage SM policy guarantees no less than 0% even if the percentage change in the market index is negative. The AccumUL Answers policy uses a declared interest rate that is guaranteed to earn at least 2% annually towards cash value accumulation. A multitude of riders are available depending on the policy.

Mutual of Omaha Life Insurance Prices

There are many factors that affect life insurance premiums. Length of term, amount of coverage, age and gender of insured, health and family history, smoking, hobbies and occupation are all determining factors in qualification and premium determination for life insurance. Mutual of Omaha has a wide range of policies to suit everyone. US News and World Report ranked Mutual of Omaha as one of the most affordable life insurance companies in its recent article.

How much life insurance do I need?

The amount of life insurance each person needs is determined by your age, financial strength, and the particular needs of your family. Mutual of Omaha has online tools that can help you determine your individual needs and professional agents who can guide you and customize your policy for you and your family.

Mutual of Omaha Life Insurance Pros and Cons

Mutual of Omaha has a long history of financial strength and a wide variety of product offerings. A Whole Life offering without a medical exam is available and offers low coverage minimum options, while other options include over $1 million in death benefits and flexible options to grow with you. A wide variety of riders means you can customize your policy for your family’s needs.

Many policies require purchase through an agent, which may or may not be convenient to you. You can locate an agent through their online search or call 800-775-6000. Mutual of Omaha does not currently offer a mobile app to view policies or self-service. They do have a Customer Access portal where many functions can be completed.

FAQ

How good is Mutual of Omaha life insurance?

Mutual of Omaha has earned strong ratings from A.M. Best, Moody’s, and S&P Global. These are some of the largest and most respected rating agencies. This means Mutual of Omaha has the financial strength to be around for the long haul and to pay claims on their policies. In addition, Mutual of Omaha ranked #5 in J.D. Power’s 2020 study of overall customer satisfaction.

How do I cancel a Mutual of Omaha life insurance policy?

There are several options for canceling your Mutual of Omaha life insurance policy. Options will be specifically listed in the original policy contract. However, below are a few convenient ways to cancel your Mutual of Omaha policy.

By phone:

- Call the Mutual of Omaha customer service number at 800-775-6000.

- Be prepared to provide your policy number and other identifying information.

- Request policy cancellation.

By mail:

- Provide a statement of intent to cancel your policy, along with your name, policy number or coverage ID, date of birth, signature, and date.

- Mail to: Mutual of Omaha, 3300 Mutual of Omaha Plaza, Omaha, NE 68175

By fax:

- Provide a statement of intent to cancel your policy, along with your name, policy number or coverage ID, date of birth, signature, and date.

- Fax to: ATTN: POS 402-997-1906

Where can I contact Mutual of Omaha?

You can contact Mutual of Omaha through their toll-free number 800-775-6000. You can also request a call-back with their online link to avoid hold times. A 24/7 automated phone system is available for making payments and requesting policy status, values, due date, and payment amount.

For many transactions, you can manage your policy and account online through their self-service customer access option. Examples of self-service features include updating personal and billing information, making payments, changing payment options, and reviewing your policies.

Can I make a payment online with Mutual of Omaha?

You can make a payment online through Mutual of Omaha’s Customer Access online portal. You can log in here, or register for Customer Access. For your security, in order to register you will need your policy or coverage ID number, policy owner’s or insured’s date of birth, and the last four digits of the social security number. Once you log in, there will be a variety of self-service options, including making a payment and the ability to view your policies.

Does Mutual of Omaha offer a 401K?

Mutual of Omaha offers defined contribution plans, including 401K’s, defined benefit plans, and retirement income annuities. You can find out more about Mutual of Omaha’s retirement planning products and services, underwritten by United of Omaha Life Insurance Company, by calling their client services team at 888-917-7120, emailing the team, or requesting information through their online form.

What types of life insurance does Mutual of Omaha offer?

Mutual of Omaha offers a variety of life insurance policy types including term life insurance, whole life insurance, and universal life insurance. While all of these policies provide a death benefit, each one has its own features and benefits that set it apart. Some examples of the differences in these policies are flexibility, affordability, and longevity. Speaking with a knowledgeable Mutual of Omaha agent can help you decide what type of life insurance is best for you.

How do I sign in to Mutual of Omaha?

You can access the Mutual of Omaha customer login at mutualofomaha.com in the right corner of the page or here. This link will lead you to the Customer Access portal where you can sign in or register for access if you have not already. For registration, have your policy information, such as your policy number or coverage ID close by. Once you have registered, you will have access to all of the online portal capabilities.

Summary

Mutual of Omaha Life Insurance Company has served its customers for over a century with trusted financial strength and commitment to the entire customer life journey. Their website provides basic life insurance education and the ability to research options, as well as easy ways to reach out for more advice. Mutual of Omaha’s diversity of product offerings has something to fit every need at every budget. Whether just starting out or needing to protect a lifetime of assets, Mutual of Omaha has the experience and knowledge to guide you to the policy best suited for your family.