There are several ways to manage your USAA auto insurance account; by going to the website and signing in via the login form, or by using the iOS/Android mobile app (download links are at the top of the page). Features of the mobile app for insurance accounts include the ability to pay your bills from your smartphone, download/request a new insurance ID card, receive roadside assistance, as well as file claims. The instructions in the guides below details how to access your account from the website, from a mobile device, how to register a new account, what to do if you forgot your password, as well as how to report a claim online.

USAA login

How to Log In

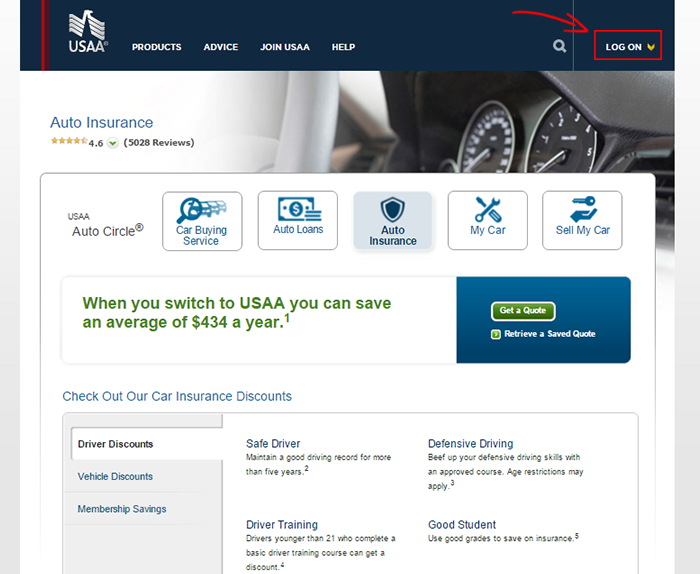

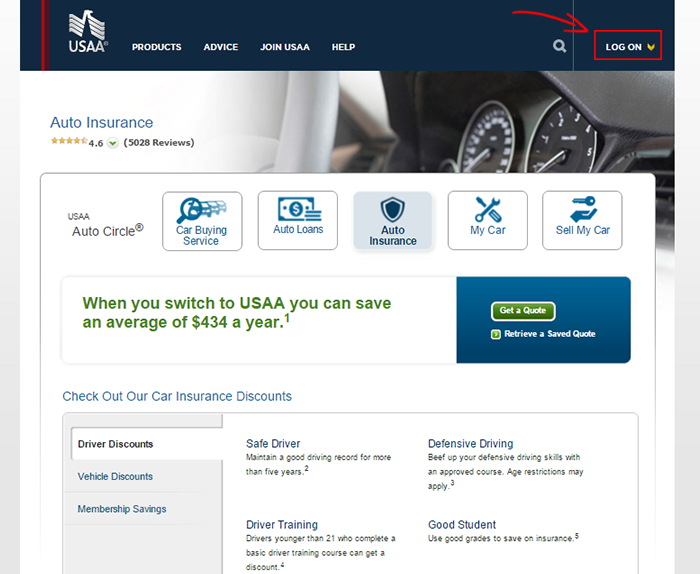

Step 1 – Start by clicking the ‘Login’ button at the top of this page to be taken to the main auto insurance page.

Step 2 – Click the ‘Log On’ link in the upper right corner of the page (seen in the image below, outlined in red).

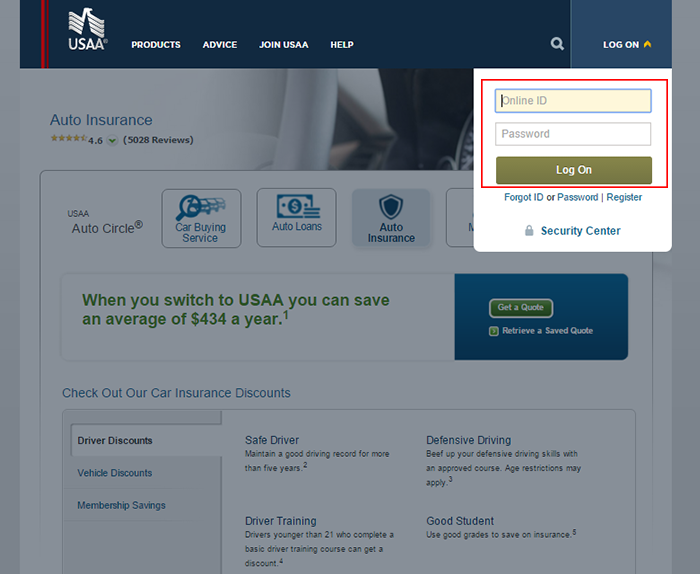

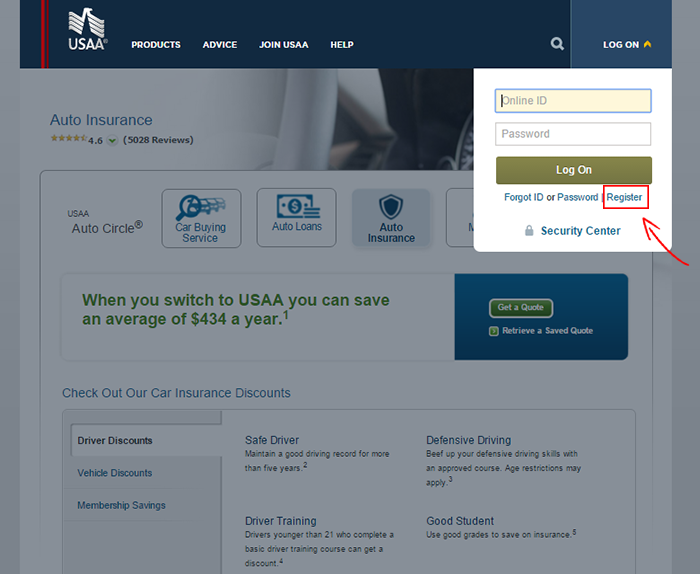

Step 3 – Enter your ‘Online ID’ and password into the form that drops down, and then press ‘Log On.’

Note: You may be required to provide additional details in order to verify your identity.

Forgot Password

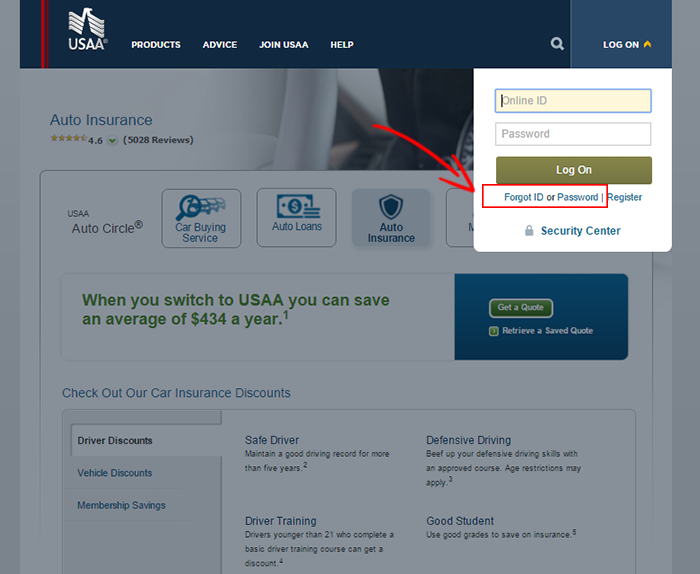

-Press ‘Password’ on the login form (as outlined in the screenshot).

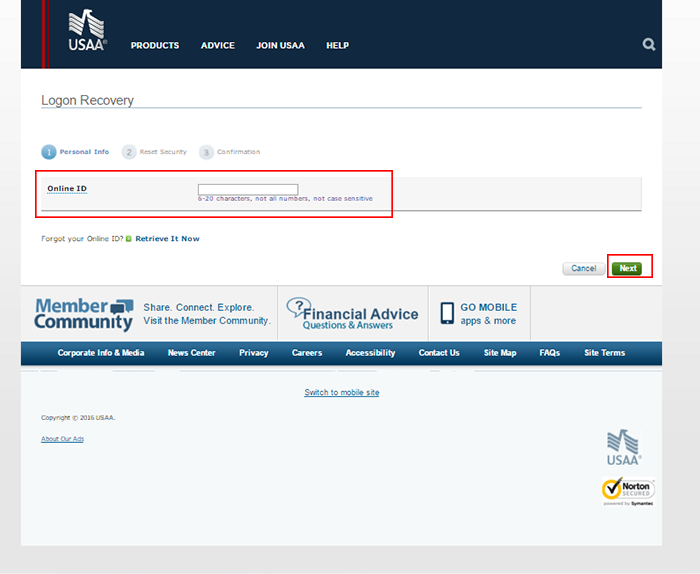

-Once on the ‘Logon Recovery’ page, enter your online ID into the blank field and click ‘Next.’ There are two more steps to the password recovery process that must be completed (‘Reset Security’ and ‘Confirmation’).

Enroll in Online Access

Step 1 – On any USAA webpage, click the ‘Log On’ link in the upper right corner.

Step 2 – The drop-down login form will generate, press ‘Register’ to be transferred to the five-step account registration form.

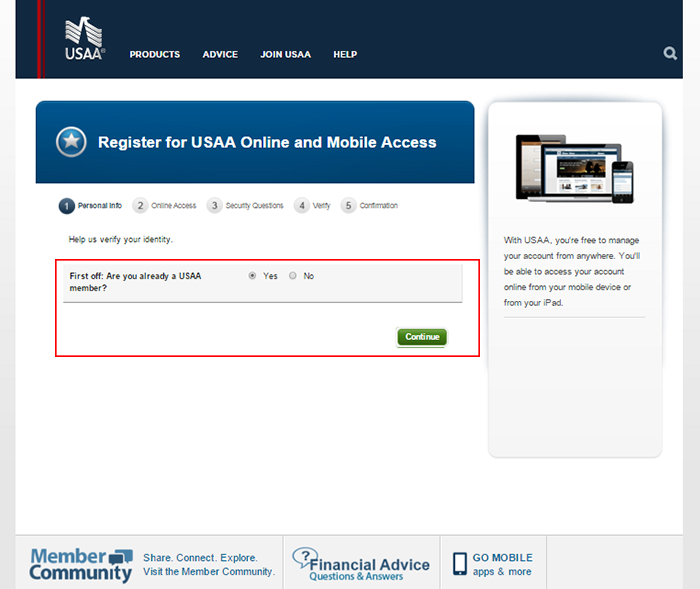

Step 3 – In the first section (‘Personal Info’), select whether or not your are a current customer. Press ‘Continue.’

Note: Depending on your answer, you may need to verify your membership, or provide your personal information during this step.

Step 4 – Continue the sign-up process by following the on-screen instructions.

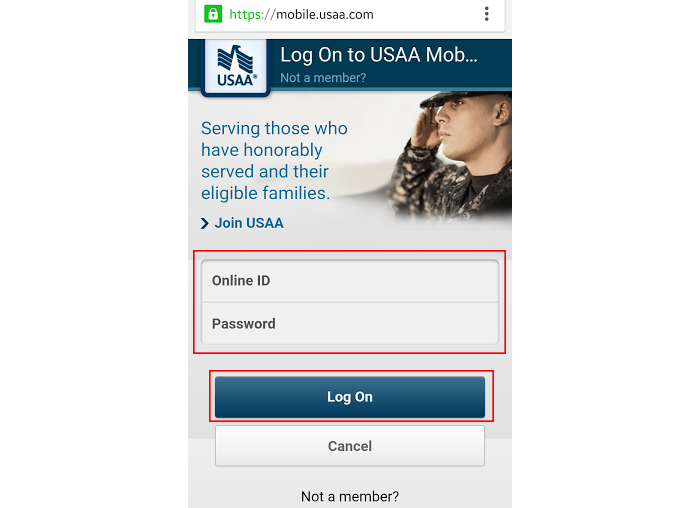

Mobile Log In

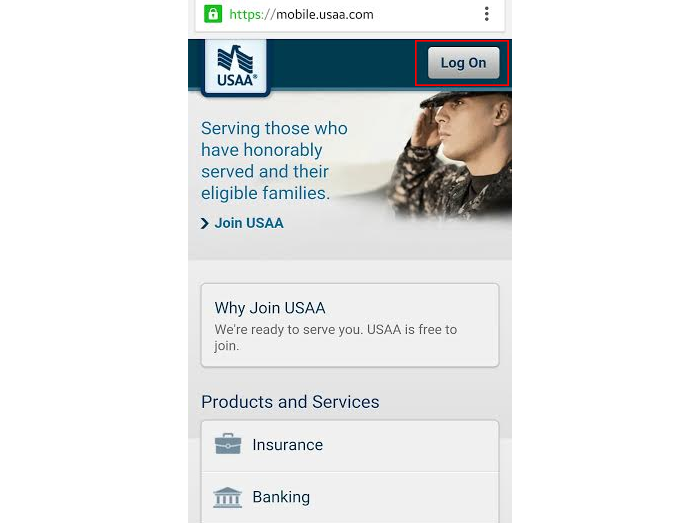

Step 1 – Enter www.usaa.com into your mobile device’s web browser.

Step 2 – Press the large ‘Log On’ button.

Step 3 – Enter your online ID and password.

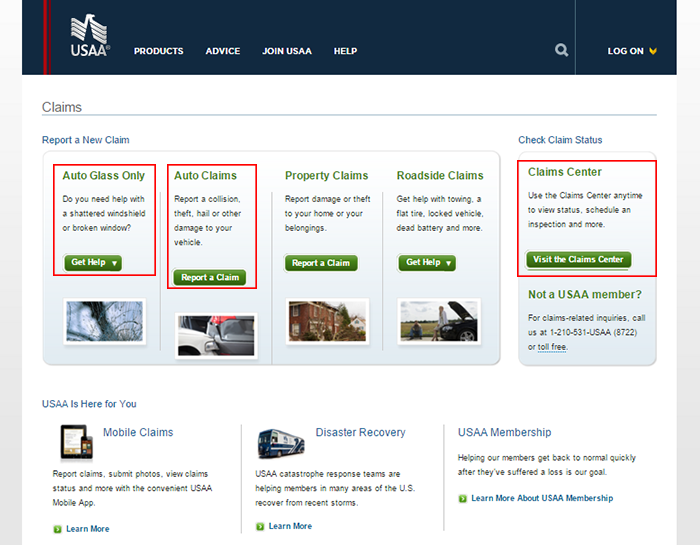

Make a Claim

Step 1 – Go to the main claims page here.

Step 2 – Click the ‘Get Help’ button if you are filing an auto glass claim. Otherwise, press ‘Report a Claim’ under the ‘Auto Claims’ section.

Note: If you are not a customer, but need to file a claim with USAA, call 1-210-531-8722. If you are a customer, and need to check the status of an existing claim, you need to sign in to your account.

USAA Auto Insurance Company Review

United Services Automobile Association (USAA) was founded in 1922 when 25 Army offices met in San Antonio to insure each other’s automobiles. At the time, members of the military were considered a high-risk group and had trouble finding quality insurance. These 25 officers sought to change that. In 1923, USAA expanded its membership to include Navy and Marine Corp officers. Today, USAA offers a wide range of insurance and financial products to active and retired servicemen and women in all branches of the military, their spouses, and their children.

USAA is known for its financial strength and numerous customer service awards. It is consistently positioned among the most affordable and reliable auto insurance companies. It has been ranked in the top 200 companies by Fortune 500 and its financial strength rating is the highest given by industry standards, such as A.M. Best, Moody’s, and Standard & Poors.

Becoming a member of USAA is made simple through user-friendly interaction on the phone, online, or on the USAA mobile app.

Types of coverages offered by USAA Auto Insurance

Auto insurance can be purchased through USAA for personal cars and trucks. Through its 3rd party carriers, USAA also offers insurance for motorcycles, mopeds, ATVs, antique and collector cars, motor homes, watercraft, and aircraft.

Coverages offered for USAA auto insurance policies include:

- Liability – This coverage provides protection for your assets and provides compensation for injury to individuals or their property for which you are held legally liable. Most states have required state minimum liability limits.

- Comprehensive – Often also referred to as “other than collision,” comprehensive coverage protects your automobile when damaged in covered events other than a collision. This could include glass breakage, hail, and theft to name a few. A deductible may apply.

- Collision – If your vehicle is damaged due to a collision with another vehicle or stationary object, collision coverage provides for the repair or replacement of your vehicle. A deductible usually applies. If your vehicle is financed, you will likely be required to carry comprehensive and collision coverage by your lender.

- Uninsured and Underinsured – If you or your passengers are injured or your vehicle is damaged by an underinsured or uninsured driver (also a hit-and-run), this coverage may pay or help pay for injuries and/or property damage.

While the coverages listed above are the primary coverages needed to comply with state laws and/or lender requirements, USAA offers additional coverages for peace of mind and added protection.

- Personal Injury Protection (PIP) – This coverage can be added as additional protection to your health insurance for larger medical claims due to an accident.

- Roadside Assistance – If your vehicle needs to be towed, roadside assistance can help.

- Rental Reimbursement – Your vehicle may be inoperable for a time due to a claim. Rental reimbursement can help you find a temporary rental car solution.

If you use your vehicle for ridesharing or delivery, USAA may also be able to help with Rideshare Insurance. Although many rideshare and delivery companies have commercial insurance policies to cover their drivers, there may be a gap in coverage between your personal auto insurance and the commercial policy from the time you are logged on to the rideshare app until you’ve accepted a request. This coverage fills that gap to protect your vehicle, your income, and your legal liability.

USAA Auto Insurance prices

USAA ranks as having lower auto insurance premiums than any other insurance company in a 2021 study by U.S. News & World Report, with an average annual auto insurance premium of $875. Members can help keep their rates low by utilizing discounts and bundling opportunities.

USAA Auto Insurance discounts

Many discounts are available through USAA’s auto insurance policies. These discount options put you in control of your insurance premiums.

Some of the discounts are based on your driving:

- Safe Driver – When you maintain a good driving record for over five years, you earn a safe driver discount.

- Defensive Driving – Completing an approved driving skills course earns this discount.

- Driver Training – This discount is available to drivers who complete a basic driver training course.

- Good Student – Maintaining good grades will qualify you for a good student discount.

USAA also offers discounts specific to your vehicle:

- New Vehicle – Vehicles less than 3 years old qualify for this discount.

- Multi-vehicle – This discount is applied when you insure two or more vehicles.

- Annual Mileage – A discount is applied based on the number of miles driven in a year.

- Vehicle Storage – An up to 60% discount is available for insured vehicles that are stored.

Additionally, because USAA is member-based, there are discounts connected to your membership:

- Family Discount – If your parents are current USAA members, you could save up to 10% on your policy.

- Length of Membership – The longer you remain a USAA member, the more you can save.

- Military Installation – If your vehicle is garaged on base, you could save up to 15% on your comprehensive coverage.

- No Payment Plan Fee – Paying your policy in full, rather than on a payment plan, can offer additional savings.

USAA offers multiple times of policies. Additional savings may be available by bundling multiple types of insurance policies.

USAA Auto Insurance Pros and Cons

USAA is a well-established, highly respected auto insurance company. Their premiums are among the lowest in the industry. They have a wide range of discounts available and convenient tools for managing your policies.

In order to take advantage of the great premiums and service available through USAA, you must qualify for membership. USAA products and services are only open to current and former military, their spouses, and their children.

FAQ

How do I contact USAA auto insurance?

You can reach USAA through their main toll-free number 800-531-USAA (8722) or 210-531-USAA (8722). If you need to access your roadside assistance, call 1-800-531-8555 or make your request online for faster service. For online claims service, visit their claim center to file a claim, check the status of an existing claim, or contact your adjuster. Additionally, you can manage your auto insurance policy online with your USAA auto insurance login or from the USAA mobile app.

With the USAA mobile app, you can get an auto ID card, report claims, request roadside assistance, and review an accident checklist. You also have access to member discounts like travel deals, home solutions, and online shopping.

How do I get a quote from USAA Auto Insurance?

USAA makes it easy to get an auto insurance quote online, or by calling 1-800-531-USAA (8722) and speaking to a knowledgeable representative.

What are USAA insurance working hours?

Customer service for USAA is available at the following times:

- M-F 7am-7pm (CT)

- Sat. 8am-4:30pm (CT)

Where are USAA insurance company offices located?

The headquarters for USAA is located in scenic San Antonio, Texas at 9800 Fredericksburg Road. It is the largest privately held company in San Antonio and employs over 36,000 people.

Does USAA offer life insurance?

USAA Life Insurance Company and USAA Life Insurance Company of New York offer both permanent and term life insurance plans.

Is there a membership fee for USAA?

USAA Life Insurance Company and USAA Life Insurance Company of New York offer both permanent and term life insurance plans.

Is there a membership fee for USAA?

Creating a member account with USAA is free and there are no membership fees. Eligibility includes the following:

- Active Duty, Guard, or Reserve – This includes those currently servicing in the U.S. Air Force, Army, Coast Guard, Marines, Navy, National Guard, and Reserves.

- Veterans – All servicemen or women with an Honorable discharge from the U.S. Military.

- Eligible Family – Current spouses, widows, widowers, and former spouses of USAA members who have not remarried. Children of eligible members.

- Cadets and Midshipmen – Officer candidates within 24 months of commissioning, Cadets and Midshipmen at US service academies or academy preparatory schools, and those in advanced ROTC or on ROTC scholarship.

See eligibility guidelines for more details.

How do I cancel my lender-placed insurance policy with USAA insurance?

To cancel any USAA policy, contact customer service at 1-800-531-USAA (8722) and ask to speak to an agent. You will need to verify your account and can then request cancellation of your policy. You’ll be sent a pro-rated refund when applicable.

Is there a cancellation fee with USAA insurance?

No, there is never a cancellation fee with USAA. You may still be responsible for any outstanding premiums but a cancellation fee will not be applied.

How will my lender know I’ve secured the required auto coverage?

You provide the contact information given to you by your lender when applying for your policy and USAA will take care of the rest. Your finance company will be notified of your continued insurance at each renewal.

Summary

USAA auto insurance is an established and well-respected auto insurance leader. Their commitment to members of the military and their families is commendable. Beyond that, USAA offers top-notch customer service, quality coverage options, and substantial discounts for its members. With an easy-to-navigate website, experienced customer service representatives, and a mobile app that puts your policy information at your fingertips, doing business with USAA is hassle-free. For service members, their spouses, and children, USAA auto insurance is a great choice.