Current VSP policyholders can make payments, view policy details, print out ID cards, and perform other administrative tasks 24/7 by using the online policy management system. Vision claims can be filed online as well by signing in to their account. If you are not yet enrolled in online access, follow the steps in the below section to learn how to create an account.

VSP login

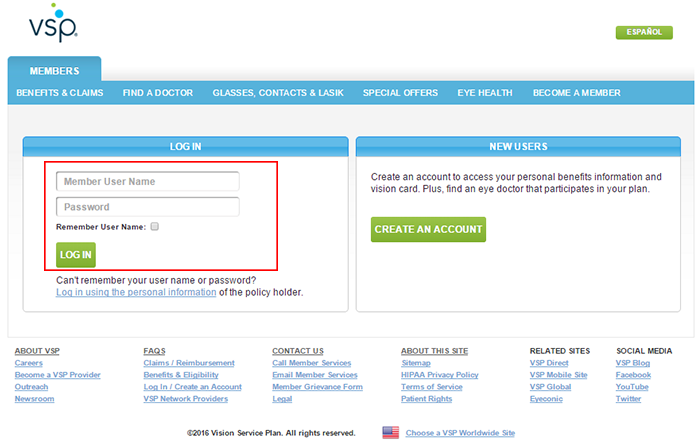

How to Log In

Step 1 – Go to the main login page by clicking the link at the top of this page, or by entering www.vsp.com/log-in into your web browser.

Step 2 – Enter your username and password, and then click ‘Log In’ to access your account.

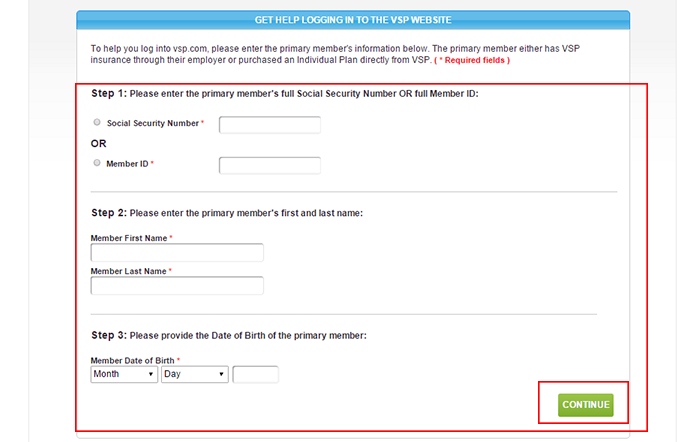

Forgot Password – If you do not know your login credentials, click the ‘Login using personal credentials’ link below the sign-in form. Enter your SSN or member ID into the first section, and then enter your first name, last name, and date of birth into the second section. Press ‘Continue’ to go to the next step. Continue to follow the on-screen instructions in order to gain access to your online account.

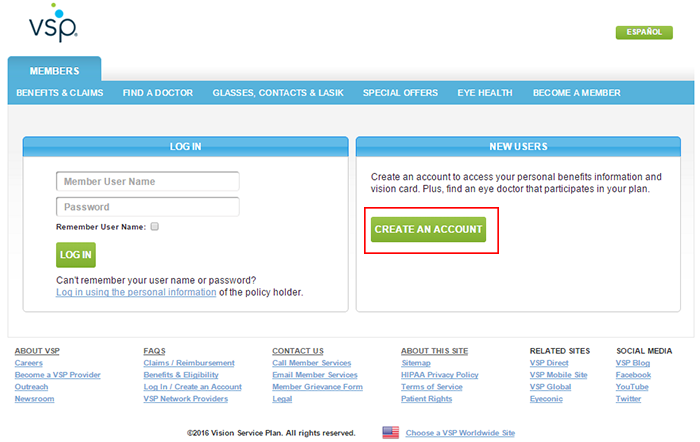

Enroll in Online Access

Step 1 – Starting from the main sign-in page, click the ‘Create an Account’ link on the right side of the page. The member registration page will load.

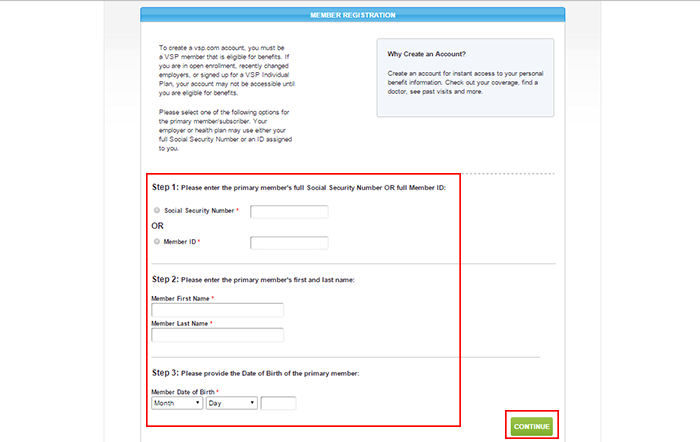

Step 2 – Enter your social security number or member ID into the first section.

Step 3 – Enter your first/last name, and then date of birth into the second section. Click ‘Continue’ to go to the next step (where you will create your username/password).

Make a Claim

Step 1 – Sign in to your account.

Step 2 – Go to the ‘Claims & Reimbursement’ page.

Step 3 – Fill out the claims form and submit it for processing.

Note: Processing time varies, but typically takes around 10 business days to complete (from the initial processing to the reimbursement). The claims FAQ page can be viewed by clicking this link.

VSP Insurance Review

VSP is an eye insurance carrier that is not only the biggest one in the United States but also the only carrier that offers not-for-profit plans. Vision plans with VSP are high quality and very affordable, and their plans are accepted by over 36,000 providers that specialize in eye care. The company was founded in 1955 by a group of optometrists and it now has over 88 million members worldwide. The insurance offered is great for many people and their plans are especially beneficial for senior citizens since they have allowances that are high for both glasses as well as contacts.

VSP has many additional benefits available to its members. These benefits kick in within one business day after you purchase a plan, include:

- Flexible options for the start date and payment options per month.

- An extensive network of doctors that are qualified.

- Access to unique offers and discounts for vision members.

- They offer plans that are affordable and can start for as little as $13 per month.

- They offer coverage for some enhancement of lenses.

The VSP Individual plans are great for:

- People that want affordable vision care insurance – There are affordable plans, as little as $13 per month, and they have very low-cost co-pays, no matter what your budget, there is a VSP plan for you.

- People that would like to have customized frames for glasses – VSP offers light tinting and dark tinting, and everything in between they also have coatings that are anti-glare and ones that are scratch resistant. They can also show you the way to make your frames sturdier and more durable.

- People that want to see a doctor in the VSP network – In order to get the most benefit from your VSP plan it is best to see a doctor in the network.

- People having issues finding vision insurance in the state they live – VSP has fantastic overage across the United States, and they can be a great choice if you line in an area that does not have a lot of providers.

- People that need glasses – This is pretty basic, but with all VSP offers they are great for anyone that needs glasses or contacts. You will have an annual allowance and you can then use it for both glasses and contact lenses.

On the VSP website you will see the VSP login where you can manage your policy as well as make payments on your premiums.

Types of Coverage VSP Insurance Offers

There are four plans that VSP eye insurance offers, which are:

- Standard

- EasyOptions

- Enhanced

- EyewearOnly 120

The most affordable plan is the Standard one which offers coverage for a yearly eye examination as well as basic styles of glasses as well as contact lenses. The plan also gives you the chance to upgrade to lenses that are progressive multi-focal, as well as tinting (from light to dark), these upgrades come with an additional cost.

The EasyOptions plan and Enhanced plan can be more beneficial if you want to have lenses on your glasses with further enhancements, or if you want tinted lenses. The EasyOptions plan also has a higher allowance for frames, as well as contact lenses. For lenses that are progressive multi-focal, or tinting that is light to dark there is no additional fee. The Enhanced plan might be a good fit for you if you want lenses that are more premium and that have anti-glare, are scratch resistant, and have special coatings to protect from impact.

The EyewearOnly 120 plan is best suited for people that simply want to get new glasses or contact lenses and have a prescription. For this plan there is no need for a medical examination. There are some VSP members that can get an annual exam through the health insurance that they have but do not have vision coverage for glasses or contacts that are prescribed, this plan is for those customers.

There are many VSP benefits, however, VSP vision insurance does not cover costs for eye surgeries or other vision therapies. These things are covered by health insurance plans and are not covered by vision insurance. However, VSP vision insurance does offer a discount of 15% on laser vision surgery of a corrective nature as long as the cost is on par with other similar surgeries and is done by a provider that is an approved one by VSP.

VSP Insurance Prices

As a non-profit vision insurance company, plans with VSP are very affordable, even for those on a budget. The cost of the coverage will depend on what plan you choose and where you live. It will also cost you less if you use an VSP in-service provider, you can choose not to use one, but you will have the pay the full cost up front and VSP will reimburse you after you file a claim, however, the coverage will not be 100%. On the VSP eye insurance website you can get pricing information by using your VSP sign in. You can also get pricing info by calling the VSP phone number 1-800-877-7195 (Monday – Friday 5 a.m. to 6 p.m., PST and Saturday & Sunday 7 a.m. to 5 p.m. PST).

VSP Insurance Discounts

There are not discounts on any plans, however as a VSP member there are many discounts on products and services. On the VSP member website you will see the categories of what you can get benefits for in:

- Offers

- Bonus Offers

- Glasses & Sunglasses

- Contacts

- Special Offers

- Glasses & Sunglasses

- Contacts

- LASIK

- Diabetes Care

- Hearing Aids

- Financing

- VSP Simple Values

A few examples of many discounts for products and services available for VSP eye insurance members include:

- Get an Extra $20 on Featured Frame Brands

- 25% off Custom LASIK and Custom PRK

- VSP Members Save $25 on Dragon Sunglasses

- Get 20% off LASIK at TLC—Nationwide Locations

- Save an Average of $325 on Nike Prescription Sunglasses

- Save Up to 40% on SunSync Light-Reactive Lenses

VSP Insurance Pros and Cons

Pros

- Affordable vision insurance

- Many in-network doctors

- Many benefits for VSP members

- VSP members can save on many products and services

- Great VSP customer service

- Easy to find VSP providers

- Manage policy online through VSP vision login

Cons

- Low coverage limits

- Not 100% reimbursement if using doctors not in VSP network

- Limited out of network benefits

- No plan-related discounts

FAQ

What is VSP?

VSP is a non-profit vision insurance company that offers solid eye insurance coverage at a very affordable price.

Does VSP vision insurance offer eye coverage?

Yes. VSP offers eye coverage for eye examinations, enhancements for glasses and lens, or contacts.

How to sign in to VSP insurance?

You can sign into VSP insurance login on the company’s website.

What does VSP stand for?

VSP stands for Vision Service Plan.

What are the nearest VSP providers near me?

You can find VSP providers near me here and on that page you can find them if you are a VSP member or not simply by inputting your zip code.

How can I contact VSP vision insurance?

You can contact VSP vision insurance by phone or by e-mail. The main VSP customer service number is 1 800-877-7195 (Monday – Friday 5 a.m. to 6 p.m., PST and Saturday & Sunday 7 a.m. to 5 p.m. PST). On this page you can see the Email member services and addresses. On the VSP Individual Plans site you can call them at 800 785-0699 and also on this site is live chat.

How to make a claim with VSP vision?

If you use a VSP in-network provider, you will not need to file a claim you only file one if you use a out-of-network provider. To file a claim, you can do so over the phone, by mail, or online using the guardian VSP login. You will need to give information such as the date of the visit, the doctor’s name, and the service received and the cost.

Does VSP insurance provide glasses?

No. They offer coverage for glasses as the providers in the network are the ones that will physically give you the glasses.

Does VSP cover Lasik?

VSP does not cover Lasik, but eligible members can save money on Lasik surgery through various discounts.

Who accepts VSP insurance?

VSP insurance is accepted by over 36,000 eye care providers in the United States.

Summary

VSP eye insurance is a non-profit vision insurance carrier that offers great coverage at low prices. There are over 36,000 providers that accept VSP insurance and there are various plans available. Being a VSP member gives you many benefits and while there are not discounts for plans there are discounts for various products and services. They are a reputable and established company that was established in 1955 and is a great option for vision insurance.