Apparently, there are ways on how to use life insurance while alive by cashing out. It’s called living benefits, and it can help you cover medical expenses, pay off debts, or even fund your retirement. So don’t think of life insurance as just a safety net for your loved ones after you’re gone – it can also be a valuable tool for your own financial planning.

Can You Use Life Insurance While Alive

Life insurance can also provide you with financial security and opportunities during your lifetime. Let’s explore how you can use life insurance while you’re still alive.

Living benefits can provide policyholders with financial support during difficult times such as an event of a serious illness or injury. Unlike traditional life insurance policies that only pay out after the policyholder’s death, living benefits allow policyholders to use a portion of their policy’s death benefit while they are still alive.

This can help cover medical expenses, lost income, and other costs associated with a serious health issue.

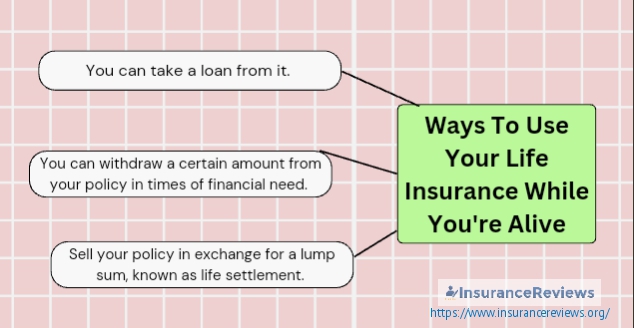

- One option is to take out a loan against the policy’s cash value, which can be paid back over time with interest.

- Another option is to withdraw a portion of the cash value, which reduces the death benefit of the policy.

- You could also sell the policy to a third-party investor for a lump sum payment, which is known as a life settlement.

What is Cashing Out A Life Insurance Policy?

Cashing out a life insurance policy refers to the process of withdrawing the accumulated cash value of the policy before its maturity or the death of the insured. This is a quick and simple way to access the funds tied up in a life insurance policy, but it can have consequences such as reducing the death benefit or incurring taxes and penalties.

About Cashing In vs. Cashing Out Life Insurance

Cashing In

Cashing in a life insurance policy means that the policyholder is surrendering their coverage in exchange for a lump sum payout from the insurance company. It can be a useful option for those who no longer need or can no longer afford the coverage and is available for permanent life insurance policies, such as whole life or universal life, which have a cash value component that grows over time.

By surrendering the policy, the policyholder forfeits any future death benefit that may have been paid out to their beneficiaries.

Cashing Out

On the other hand, cashing out a life insurance policy is the process of surrendering the policy and receiving its cash value. This can be done for various reasons, such as needing the money for a financial emergency, no longer being able to afford the premiums, or simply no longer needing the coverage.

Cashing Out Life Insurance Policies

Cashing out life insurance policies is often done when the policy is no longer needed, or the premiums become too expensive to maintain. While it may provide a quick infusion of cash, it’s important to consider the potential tax consequences and the impact on your overall financial plan before making a decision.

Cash Out Whole Life insurance Policy

Cashing out a whole life insurance policy entails surrendering the policy in exchange for its cash value. Whole life insurance policies come with a cash value component that grows over time, which can be used by policyholders through a surrender or partial surrender of the policy.

The options for cashing out may vary depending on the policy’s terms and conditions and may come with tax implications. While cashing out can provide policyholders to get a hold of immediate funds, it may also result in the forfeiture of the policy’s death benefit.

Cash Out Term Life Insurance Policy

Cashing out term life insurance policy can be very helpful for those who need immediate funds for sudden expenses or emergencies. To cash out a term life insurance policy, the policyholder has to contact their insurance provider and fill out the necessary paperwork. The amount of cash payout will depend on the policy’s terms and the amount of premiums paid and may result in the termination of the policy.

Living Benefits – Cash Out Life Insurance While Still Alive

Living benefits, also known as accelerated death benefits, means deciding to use a portion of your life insurance policy’s death benefit while you are still alive.

This type of benefit can be particularly helpful if you are facing a terminal illness, chronic illness, or critical injury, and you need funds to cover your medical expenses, pay off debts, or address other financial needs.

Depending on the terms of your policy, you may be able to cash out a portion of the death benefit or receive regular payments for a specified period.

Chronic Illness Benefits

Chronic Illness benefits serve as an additional layer of financial protection for policyholders who are diagnosed with a chronic medical condition. These benefits act as a means for policyholders to withdraw a portion of their life insurance policy’s death benefit while they are still alive and dealing with a chronic illness.

Certainly, this type of benefit can greatly help to cover medical expenses, caregiving costs, and other related expenses. For policyholders who are facing health problems, cashing out their life insurance gives them peace of mind, and helps alleviate some of the financial burdens that can come with a chronic illness diagnosis.

Long-term Care

No matter the policyholder’s age and health status, the benefits for long-term care can immensely help them pay for the costs associated with receiving ongoing assistance with activities of daily living, such as bathing, dressing, and eating, due to a chronic illness or disability.

These benefits can be provided in a variety of settings, including at home, in a nursing facility, or in an assisted living facility. Long-term care benefits are designed to act as their financial protection, brings peace of mind to individuals and their families, especially as they age and their healthcare needs become more complex.

Terminal Illness Benefit

Terminal illness benefit is a provision offered by some life insurance policies that allows the policyholder to receive a portion of money from their life insurance policy while they are still alive, if they are diagnosed with a terminal illness and have a limited life expectancy.

In such cases, the policyholder can receive a lump sum or regular payments from the policy before their death, which can help cover medical expenses and other costs associated with end-of-life care. This benefit can provide financial support to the policyholder and their family during a difficult time.

Life Settlement

Life settlement means selling one’s life insurance policy to another person in exchange for a lump sum payment, which is usually higher than the policy’s surrender value. This option proves to be advantageous to policyholders to get paid immediately, while the buyer assumes the responsibility of paying future premiums and ultimately collects the death benefit upon the insured’s passing.

In that regard, many policyholders turn to life settlements—because they no longer need or want their life insurance policy, or by those who are facing difficulties in keeping up with premium payments.

Should You Cash Out Your Life Insurance

There will be times in our lives that the need to keep up with expenses can happen. Thanks to life insurance, cashing out some of the money off of our policy is possible. Even if it means surrendering the policy so we get paid right after, what’s important is that investing in life insurance has paid off, in many ways.

However, this decision can have both positive and negative consequences:

On the positive side, cashing out your life insurance policy can bring financial relief.

It can also be an option if you no longer need the death benefit that the policy provides, or if you can no longer afford to pay the premiums.

The downside of cashing out a life insurance policy means that you will no longer have life insurance coverage. If you pass away after cashing out your policy, your beneficiaries will not receive a death benefit. In addition, cashing out a policy may result in tax consequences, particularly if the policy has a cash value that exceeds the premiums paid.

Before deciding to cash out your life insurance policy, it is important to consult with a financial advisor or insurance professional to fully understand the implications of this decision and to explore other alternatives.

Word Of Caution

Cashing out your life insurance policy while you are still alive can be viable if the policy is no longer needed, or if the cash value has accumulated to a significant amount. Keep in mind that you should always consider the tax implications and potential loss of future protection before deciding to cash out a life insurance policy.

FAQ

Can you cash out on a life insurance policy if you’re still alive?

Some life insurance policies may have a cash value component, which allows the policyholder to use some of the money they have paid into the policy while they are still alive. This cash value can be accessed through a policy loan, or by surrendering the policy.

How are you supposed to use life insurance?

Life insurance is designed to provide financial support to your beneficiaries in the event of your death. Here are some of the most common ways to use life insurance:

Provide financial support for your loved ones.

Pay for your funeral expenses.

Pay off outstanding debts.

Leave an inheritance.

What happens if you are still alive after life insurance?

If you outlive your life insurance policy, you will not receive any payout from the policy. The premiums you paid into the policy over the years are essentially the cost of the insurance coverage, and if you do not pass away during the policy term, the insurance company keeps those premiums as profit. However, some life insurance policies, such as whole life or universal life, may have a cash value component that the policyholder can use while they are still alive.

How do I cash out my whole life insurance?

To cash out your whole life insurance policy, you can contact your insurance company to surrender your policy. If you’re after the cash value of your whole life insurance policy, you may need to pay surrender charges and taxes.

What is living benefits?

Living benefits are insurance policy features for policyholders to use some, or all of the benefits of their policy before they die. These benefits can help policyholders make do with expenses related to a serious illness, injury, or disability, or provide financial assistance during times of financial hardship.

Living benefits are included in life insurance policies with other features such as accelerated death benefits, long-term care riders, critical illness riders, and disability income riders.

Can I get money back if I cancel my life insurance?

It depends on the specific terms and conditions of your life insurance policy. Some policies may have a provision for a cash value or surrender value, which means that you can receive some money back if you cancel the policy before it reaches its maturity date.

Not all life insurance policies have a cash value, and some may have penalties for canceling early. Also, the amount of money you may receive back may depend on several factors, such as the length of time you’ve had the policy, the amount of premiums you’ve paid, and any outstanding fees or charges.