Is Colonial Penn legit?

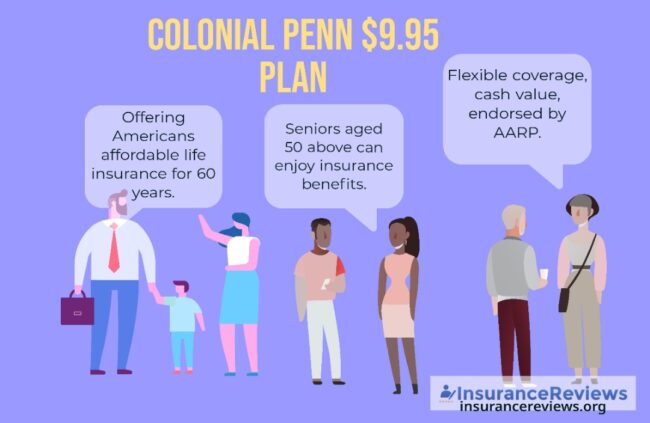

Colonial Penn is a legitimate life insurance company that has been in operation for more than 60 years. The company offers a range of insurance products, including life insurance, Medicare supplement insurance, and final expense insurance.

Colonial Penn has a strong reputation for providing affordable coverage options and exceptional customer service. The company is licensed to operate in all 50 states and the District of Columbia, and it has received high ratings from independent rating agencies such as A.M. Best and the Better Business Bureau.

It can be said that Colonial Penn is a reputable insurance provider that has helped millions of Americans secure their financial futures.

Colonial Penn’s Life Insurance Policies

Colonial Penn Life Insurance is a company that offers life insurance policies to individuals. They specialize in providing coverage for people over the age of 50 and those with health issues.

Below are the types of life insurance policies offered by that Colonial Penn:

Term Life Insurance

This type of policy provides coverage for a specific period of time, typically 10, 15, or 20 years. It is a good option for those who need temporary coverage or who want to supplement their existing coverage.

Whole Life Insurance

This policy provides coverage for the entire life of the insured person, as long as premiums are paid. It can also build cash value over time that can be borrowed against or used to pay premiums.

Guaranteed Acceptance Life Insurance

This type of policy is designed for those who may have difficulty getting coverage due to health issues. There are no medical exams or health questions required to qualify for this policy, but premiums may be higher than other types of policies.

Children’s Life Insurance

This policy provides coverage for children, with the option to convert the policy to a permanent policy later on.

Colonial Penn Pros & Cons

Most of the time, we are faced with weighing the pros and cons of choosing the most viable life insurance company for our needs. Listed below are the pros and cons of choosing Colonial Penn:

Pros

- Guaranteed Acceptance – Colonial Penn offers guaranteed acceptance for those who are between the ages of 50-85, regardless of their health condition.

- Affordable Premiums – Colonial Penn’s premiums are generally lower than the industry average, making it an affordable option for many seniors.

- Easy to Apply – The application process is simple and can be completed online or over the phone.

- No Medical Exam Required – Colonial Penn does not require a medical exam for coverage, which makes it a convenient option for those who have medical conditions.

- Flexible Coverage – Policyholders can choose from a range of coverage options, including term and whole life insurance.

- Cash Value – Colonial Penn’s whole life policies accrue cash value over time, which can be borrowed against or used to pay premiums.

- Fixed Premiums – Premiums for Colonial Penn’s whole life policies are fixed for life, which makes budgeting easier for policyholders.

- Guaranteed Death Benefit – Colonial Penn guarantees a death benefit payout to beneficiaries, which can provide peace of mind for policyholders.

- Customer Service – Colonial Penn has a reputation for excellent customer service, with a dedicated team of agents available to answer questions and provide support.

- AARP Endorsement – Colonial Penn is endorsed by AARP, which can provide additional confidence for those considering this insurer.

Cons

- Limited coverage – Some policyholders may find that the coverage provided by Colonial Penn Insurance is insufficient or restrictive compared to other insurance providers.

- High premiums – Some customers may find the premiums charged by Colonial Penn Insurance to be more expensive than other insurance providers, particularly for older individuals or those with pre-existing medical conditions.

- Limited policies – Colonial Penn Insurance may offer a limited selection of policies, which may not meet the needs of all potential policyholders.

- Low payout limits – Some policyholders may find that the payout limits for Colonial Penn Insurance policies are lower than they expected, which may not provide adequate financial protection.

- Strict underwriting guidelines – Colonial Penn Insurance may have strict underwriting guidelines, which may result in some individuals being denied coverage or charged higher premiums.

- Lack of flexibility – Colonial Penn Insurance policies may have less flexibility than other insurance providers, which may make it difficult for policyholders to make changes to their coverage or benefits.

- Limited customer service – Some customers may find that the customer service provided by Colonial Penn Insurance is lacking, particularly in terms of responsiveness and helpfulness.

- Lack of online tools – Colonial Penn Insurance may not provide the same level of online tools and resources as other insurance providers, which may make it more difficult for policyholders to manage their coverage or file claims.

- Negative reviews – Some customers may have reported negative experiences with Colonial Penn Insurance, which may discourage potential policyholders from choosing this provider.

- No medical exam policies – While some policyholders may appreciate the convenience of no medical exam policies offered by Colonial Penn Insurance, others may find that these policies come with higher premiums or less coverage than policies that require a medical exam.

What Is Colonial Penn 955?

Colonial Penn 9.95 is a type of life insurance policy offered by Colonial Penn, otherwise known as Guaranteed Acceptance life insurance policy, which means that applicants do not need to undergo a medical exam or answer any health questions to be approved for coverage.

Colonial Penn 9.95 policy is designed to provide final expense coverage to help cover end-of-life expenses, such as funeral costs, outstanding medical bills, and other debts. The policy has a death benefit ranging from $1,000 to $50,000, depending on the policyholder’s age and the premiums paid.

The premiums for Colonial Penn 995 plan are level, which means they remain the same for the life of the policy. The policy is available to individuals aged 50 to 85, and the coverage continues for the policyholder’s lifetime, as long as the premiums are paid on time.

It’s important to note that the policy has some limitations and exclusions, so it’s important to read the policy carefully before purchasing. Also, guaranteed issue policies often have higher premiums than traditional life insurance policies because the insurer takes on more risk by insuring individuals without knowing their health status.

How Colonial Plenn Works in Life Insurance Categories?

How does life insurance work in Colonial Penn? Their policies are designed to provide affordable options for those who may have difficulty obtaining coverage elsewhere. They offer both term and permanent life insurance policies, with no medical exam required for certain options.

Whole Life Colonial Penn

Colonial Penn offers whole life insurance coverage that provides permanent protection for as long as you live.

With Colonial Penn whole life insurance, you can choose coverage amounts ranging from $1,000 to $50,000.

Policyholders can enjoy a fixed premium payment schedule that remains the same throughout the life of the policy.

Colonial Penn’s whole life insurance policies also come with a 30-day money-back guarantee, giving you peace of mind in your purchase.

Term Life Insurance

Colonial Penn Term Life Insurance is a type of life insurance policy that provides coverage for a specific period of time.

With Colonial Penn Term Life Insurance, customers can choose the length of the policy term, as well as the amount of coverage they want.

This type of insurance can provide peace of mind for individuals and families who want to ensure that their loved ones are financially protected in the event of their unexpected death.

Guaranteed Whole Life Insurance

Colonial Penn Guaranteed Whole Life Insurance is a type of permanent life insurance that offers lifelong coverage.

This type of insurance guarantees a death benefit payout to your beneficiaries upon your passing, regardless of when that happens.

The policy premiums are fixed and will not increase over time, making it an attractive option for those on a fixed income or a limited budget.

Colonial Penn also offers simplified underwriting for their Guaranteed Whole Life Insurance policy, making it easier for individuals with health issues to obtain coverage.

Colonial Plenn Prices

Illustrated below is a table of policies and prices offered by Colonial Penn:

| Term Life | Whole Life | Guaranteed Acceptance | |

| Average Monthly Rates | $12 – $56 | $10 – $80 | $30 – $133 |

| Fixed Premium | No, rates increase with age | Yes | Yes |

| Death Benefit | $10,000 – $50,000 | $10,000 – $50,000 | $400 – $17,000 |

| Medical Exam | None | None | None |

| Health Survey | Yes | Yes | No |

Colonial Plenn 9.55$ per month

Colonial Penn’s 9.55$ coverage amounts range from $10,000 to $50,000, depending on age and health status. This type of policy is marketed towards seniors who are looking for affordable life insurance coverage.

Colonial Life and Colonial Penn are both insurance companies, but they are not the same company.

Colonial Life is a subsidiary of Unum Group, which offers various insurance products such as disability, accident, life, and critical illness insurance to individuals and businesses. Colonial Life focuses on providing voluntary benefits to employees, which are benefits that employees can choose to enroll in and pay for themselves, rather than benefits provided by the employer.

On the other hand, Colonial Penn is a subsidiary of CNO Financial Group, which also offers insurance products such as life, accident, and health insurance, but focuses solely on life insurance for seniors. Colonial Penn offers guaranteed acceptance life insurance policies, which do not require a medical exam or health questions to be answered.

Colonial Penn 2023 Frequently Asked Questions

How much is a unit of Colonial Penn life insurance?

With Colonial Penn, anyone who is male or female aged 50 to 70 years old can pay $9.95 per month for a single unit of coverage from Colonial Penn.

What do I get for $9.95 with Colonial Penn

Colonial Penn offers their most popular plan, the Guaranteed Acceptance Life Insurance policy, which is available for a monthly premium of $9.95.

This plan is designed for seniors who may have difficulty getting approved for traditional life insurance due to their age or health status. The policy provides coverage for final expenses, such as funeral costs, and the death benefit is guaranteed regardless of the policyholder’s health.

Is Colonial Penn’s life insurance good?

ֿDespite Colonial Penn’s limited options when it comes to insurance options, Colonial Penn has been offering affordable life insurance policies for over 60 years and is well-known for its guaranteed acceptance policies, which do not require a medical exam.

Does Colonial Penn’s Life Insurance have cash value?

Colonial Penn’s life insurance policies do not have a cash value component. These policies are known as term life insurance policies, which means they provide coverage for a specific period of time (usually 10, 15, or 20 years) and do not accumulate cash value over time.

Although Colonial Penn’s life insurance policies do not have a cash value component, they can be a good option for those looking for affordable coverage for a specific period of time. However, if you’re looking for a policy that accumulates cash value over time, you may want to consider a permanent life insurance policy, such as whole life insurance.

Does Colonial Penn have a waiting period?

Yes, Colonial Penn does have a waiting period.

For Colonial Penn’s Guaranteed Acceptance Life Insurance policy, there is a two-year waiting period before the full death benefit is paid out. However, if the policyholder dies during the waiting period, Colonial Penn will typically refund all premiums paid, plus interest.

Companies that offer Colonial Plenn

While Colonial Penn is a well-known insurance provider, the company does not sell its products through other insurance companies or agencies. Instead, customers can purchase Colonial Penn insurance products directly from the company.

To learn more about Colonial Penn’s products and services or to purchase insurance, you can visit the company’s website at www.colonialpenn.com or call the company’s toll-free number at 1-877-877-8052.

How much is Colonial Penn’s whole life insurance?

The average monthly payment for Colonial Penn’s whole life insurance starts at $10.

How much is a unit of life insurance?

On the whole, life insurance policies are priced based on a premium, which is the amount you pay to the insurance company on a regular basis (such as monthly or annually) to maintain coverage. The premium will depend on the factors mentioned above and the specific terms of the policy, such as the length of coverage and the amount of death benefit provided.

Is Colonial Life and Colonial Penn the same company?

Colonial Life and Colonial Penn are both insurance companies, but they are not the same company.

Colonial Life is a subsidiary of Unum Group, which offers various insurance products such as disability, accident, life, and critical illness insurance to individuals and businesses. Colonial Life focuses on providing voluntary benefits to employees, which are benefits that employees can choose to enroll in and pay for themselves, rather than benefits provided by the employer.

On the other hand, Colonial Penn is a subsidiary of CNO Financial Group, which also offers insurance products such as life, accident, and health insurance, but focuses solely on life insurance for seniors. Colonial Penn offers guaranteed acceptance life insurance policies, which do not require a medical exam or health questions to be answered.

Who owns Colonial Penn?

Colonial Penn Life Insurance Company is a subsidiary of CNO Financial Group, Inc. (formerly known as Conseco, Inc.), a publicly traded holding company based in Carmel, Indiana. CNO Financial Group, Inc. owns several other insurance and financial services companies, including Bankers Life, Washington National, and others.