Have you been wanting to know how much does life insurance cost and how much you’ll be paying for it? Getting around to the cost can be done by requesting an actual quote from the insurance company or an agent.

You can also use the insurance company’s calculator that will estimate your life insurance needs and can easily give you a complimentary quote for, say, a 20-year term life insurance policy – one of the most popular types of coverage available.

To better understand the intricacies of life insurance costs, we have broken down the types of life insurance policies, the average costs, and some factors that may affect coverage.

Life Insurance Costs Vary

The premiums for life insurance policies may increase or decrease based on the following factors:

Age

How much does life insurance cost for both males and females? Life insurance costs for females are generally lower than for males of the same age. However, as females age, their life insurance costs tend to increase.

Gender

Gender can affect life insurance premiums as statistics show that men tend to have a lower life expectancy than women, resulting in higher premiums for males. This is because insurers use actuarial tables to assess the risk of insuring someone, and gender is one of the factors that they consider.

Health

Age is a significant factor in determining the cost of life insurance. As individuals age, the risk of mortality increases, and this results in higher premiums for older individuals.

Smoking and Drinking

Drinking and smoking can significantly increase the cost of life insurance premiums. Insurers view these habits as higher risk factors that can lead to a shorter lifespan and a greater likelihood of health complications.

Family health history

Family health history can affect the cost of life insurance because it provides insurers with valuable information about an individual’s likelihood of developing certain health conditions. Insurers may charge higher premiums or impose exclusions or limitations on coverage based on a family’s history of certain medical conditions.

Your job and lifestyle

Lifestyle and occupation can affect the cost of life insurance because they can impact an individual’s overall health and level of risk. Insurers may charge higher premiums or impose exclusions or limitations on coverage for individuals with high-risk jobs or who engage in risky activities such as smoking, extreme sports, or hazardous occupations.

Term life vs Permanent Life Insurance

Now, how much does life insurance cost? Tobe able for you to find and understand life insurance and which one can work for you, read on.

Term life insurance:

The cost of policies is more affordable to many individuals and even families than that of permanent life insurance.

Permanent life insurance:

Policy costs have cash value accumulation and investment components that contribute to their higher costs.

Other Factors That Affect The Cost of Your Life Insurance

- The type and amount of coverage you choose— on how much does life insurance cost can also affect the cost of your life insurance. For example, a policy with a larger death benefit will have higher premiums than one with a smaller benefit.

- As well, the insurance company you choose and their underwriting process can also affect the cost of your life insurance. Different companies have different risk tolerance levels and underwriting criteria, which may result in varying premiums for the same coverage.

- The cost of life insurance premiums can be affected by the health and lifestyle of the rider being insured.

- Certain riders, such as those with a history of tobacco use or high-risk hobbies, may result in higher premiums due to the increased likelihood of premature death.

Average Cost of a Term Life Insurance Policy

In the example below, how much does life insurance cost is based on the average monthly and annual rates on the table below provides an estimate of the total cost of the policy over the 10-year period.

These rates are calculated based on genders for the amount of coverage they have chosen.

Average Monthly and Annual Life Rates for a 10 Year Policy

| Policy Amount (10 years) | Male (Monthly) | Female (Monthly) | Male (Annual) | Female (Annual) |

| $250000 | $13.19 | $11.51 | $158.28 | $138.12 |

| $500000 | $19.52 | $15.68 | $234.24 | $188.16 |

| $1000000 | $29.54 | $22.96 | $354.48 | $273.52 |

| Policy Amount (20 years) | Male (Monthly) | Female (Monthly) | Male (Annual) | Female (Annual) |

| $250000 | $17.03 | $14.10 | $204.36 | $169.20 |

| $500000 | $26.69 | $20.89 | $320.28 | $250.68 |

| $1000000 | $44.40 | $33.27 | $530.40 | $399.24 |

| Policy Amount (30 years) | Male (Monthly) | Female (Monthly) | Male (Annual) | Female (Annual) |

| $250000 | $23.73 | $19.25 | $284.76 | $231.00 |

| $500000 | $39.48 | $30.80 | $473.76 | $369. 60 |

| $1000000 | $68.22 | $51.45 | $818.64 | $617.40 |

Average Annual Cost of Whole Life Insurance

The Average Annual Cost of Whole Life Insurance varies based on certain factors. The premiums on how much does life insurance cost tend to be higher than Term Life Insurance premiums because of the added investment component.

*Table is based on a 10-year policy for for both male and female on average health with a policy of $500,000

| Age | Male | Female |

| 30 | $22.00 | $19.00 |

| 40 | $32.00 | $27.00 |

| 50 | $68.00 | $54.00 |

| 60 | $47.00 | $35.00 |

| 70 | $129.00 | $85.00 |

Average Monthly Life Insurance Costs for Non-smokers vs Smokers

On average, non-smokers pay significantly less for life insurance than smokers. This is because smoking is a risk factor that increases the likelihood of premature death, leading to higher insurance premiums for smokers.

| Risk Factor | Cost per month | Policy Term |

| Smoker | $87.71 | 10 years |

| Non-smoker | $24.82 | 10 years |

Average Monthly and Annual Cost of Life Insurance By Health

In light of how much does life insurance cost, the best life insurance companies have rating classes they use to base on the individual’s health. Although the exact names differ from one company to the next, the following are most commonly referred categories:

Super preferred refers to an insurance classification for individuals who are considered the healthiest and least risky to insure, often resulting in lower premiums and better coverage. This classification is determined based on various factors such as age, health history, and lifestyle habits.

Preferred in life insurance typically refers to individuals who are in excellent health and have a low risk of dying prematurely. As a result, they may be eligible for lower insurance premiums compared to individuals who are considered standard or high risk.

People who are average with an otherwise normal life expectancy mostly qualify for standard rates.

*Table below is an example of the average cost of annual rates for term life insurance to suit super preferred applicants based on a 20-year term life with a policy of $500,000.

| Age | Male (Average Annual Rate) | Female (Average Annual Rate) |

| 30 | $224 | $189 |

| 40 | $335 | $283 |

| 50 | $829 | $645 |

To Sum it Up

- Term life insurance typically has lower premiums than permanent life insurance because it provides coverage for a specific period of time, while permanent life insurance offers coverage for the policyholder’s entire life and includes a savings component that can increase the overall cost.

- On average, women tend to pay lower life insurance premiums than men because they have a longer life expectancy and lower rates of mortality for certain health conditions. However, determinants such as age, health, lifestyle, and occupation can also significantly impact the cost of life insurance for both genders.

- Smokers can expect to pay higher life insurance premiums compared to non-smokers. This is because smoking is a known risk factor for several health conditions that can lead to an earlier death.

- The coverage amount and insurance policy will vary depending on the individual’s personal status including health factors and risks. The higher the risk, the higher the premiums the person will have to pay.

What Happens If I Can’t Afford Life Insurance?

If you cannot afford life insurance, there is no need to worry. Many people are in the same situation and cannot afford life insurance costs.

Fortunately, there are other options available, such as state-funded life insurance programs.

These programs can provide financial support to your loved ones in the event of your passing, even if you cannot afford a private life insurance policy.

About State-funded Life Insurance

State life insurance is a type of life insurance that is offered by a state government to its residents. This is designed for individuals who have difficulty obtaining life insurance from private insurance companies on account of health issues, or other predicaments.

As such, state life insurance policies are mostly simplified issue policies, which means that the application process is streamlined and does not require a medical exam. However, the coverage limits are often lower than what is available with private insurers, and the premiums may be higher.

State-funded life insurance policies are not available in all states, and the availability and details of these policies vary from one state to another.

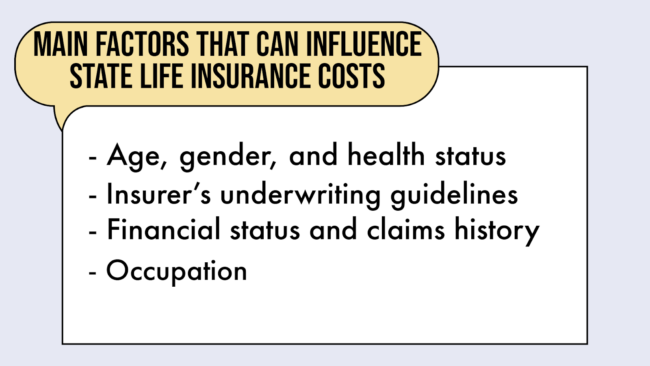

State Life Insurance Costs Vary

How much does life insurance cost for state life insurance? The costs for state life insurance wholly differ based on a variety of factors. Some of the main factors that can influence the cost of state life insurance include:

- Age, gender, and health of the insured.

- The type and amount of coverage selected.

- Insurer’s underwriting guidelines.

- Insurer’s financial stability and claims history.

- Occupation.

- Lifestyle habits.

Women generally have longer life expectancies than men, which can lead to lower premiums for females. The average cost of life insurance for females is usually lower than for males, on account of the statistical differences in life expectancy and risk factors.

In general, males tend to pay higher average premiums than females based on their higher mortality risk.

Frequently Asked Questions

Does my credit score affect the cost of life insurance?

Your credit score may affect the cost of your life insurance premium, although it depends on the insurance company and the state you live in.

Some insurance companies may use credit-based insurance scores to determine your premium rates, which takes into account your credit history and payment behavior.

Insurance companies consider credit scores as an indicator of financial responsibility, and a good credit score may imply that you are more likely to make timely payments on your premiums.

Which factors don’t affect the cost of life insurance?

There are several factors that do not affect the cost of life insurance:

- Gender – In most cases, life insurance companies cannot charge different premiums based on gender.

- Marital status – Whether you are married or single usually does not impact your life insurance rates.

- Occupation – While certain high-risk occupations may lead to higher premiums, in general, most jobs do not affect the cost of life insurance.

- Education level – Life insurance companies generally do not take education level into account when determining rates.

- Religion – Your religious beliefs or practices are not considered by life insurance companies when setting premiums.

- Political affiliation – Your political views or party affiliation are generally not factors that affect the cost of life insurance.

- Sexual orientation – Life insurance companies cannot charge different rates based on sexual orientation.

How much is term life insurance?

The cost of term life insurance varies and will be based on certain factors.

In term life insurance, the younger and healthier you are, the lower your premium will be. You can get a free quote from an insurance company to get an estimate of how much term life insurance will cost for you.

When should I buy life insurance?

It’s a good idea to buy life insurance when you have people who rely on your income and would suffer financially if you were to pass away.

You may want to speak with a financial advisor to help determine the appropriate type and amount of life insurance for your individual situation.

How much is life insurance without a medical exam?

The cost of a life insurance policy without a medical exam can vary widely depending on the provider and the specific policy you are interested in.

To get an accurate idea of the cost of life insurance without a medical exam, it is best to compare quotes from different providers and policies based on your specific circumstances.

What does preferred and super preferred mean?

In the context of life insurance, “preferred” generally refers to individuals who are in good health and have a low risk of premature death.

These individuals may qualify for lower premiums compared to standard policyholders. “Super preferred” refers to an even lower risk group— those who are in excellent health and have an exceptionally low likelihood of an early death.

Super preferred policyholders may qualify for even lower premiums than preferred policyholders.