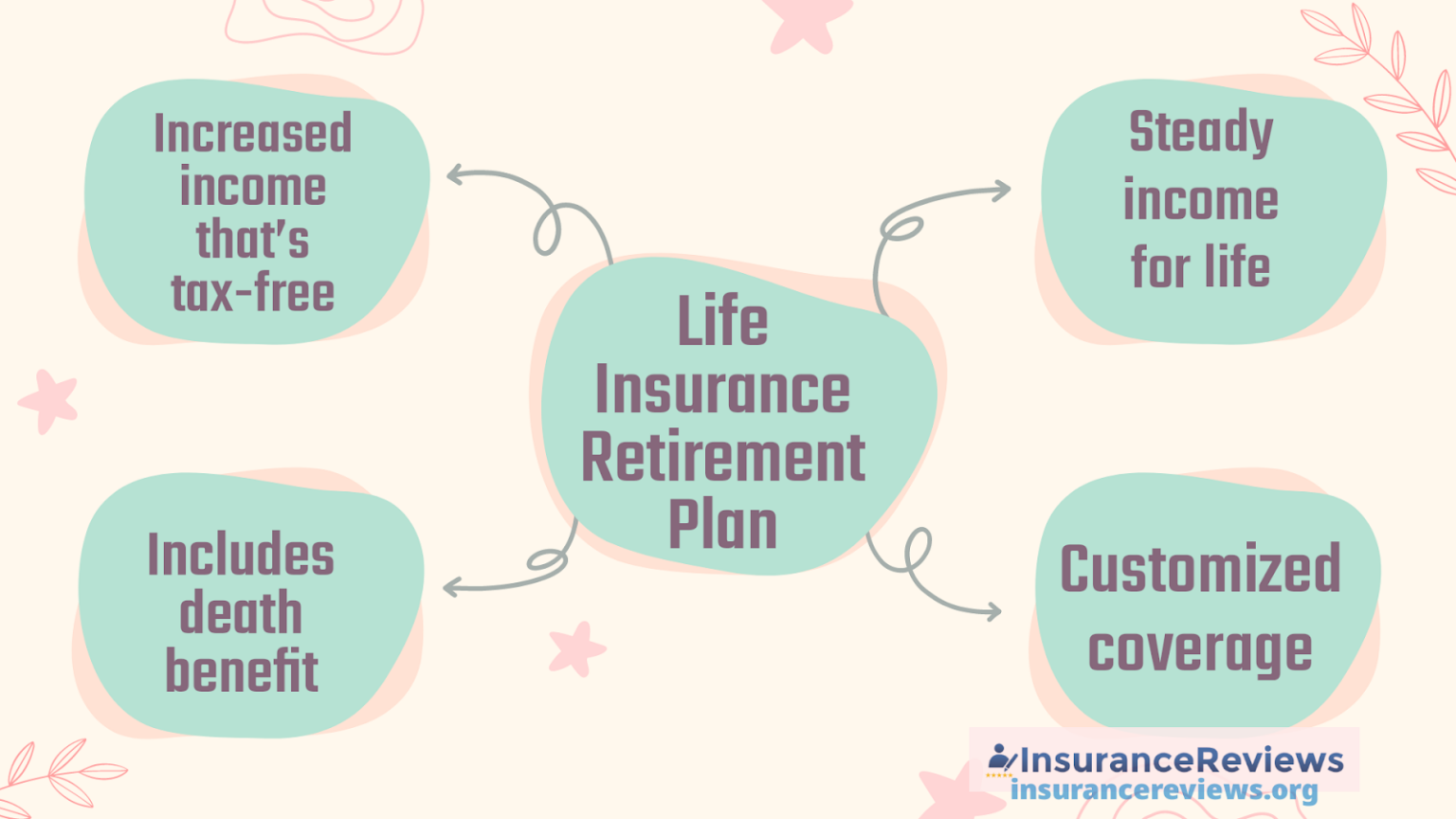

A Life Insurance Retirement Plan (LIRP) is a type of financial product that combines a life insurance policy with a tax-deferred investment account. The goal of a LIRP is to provide a tax-free income during retirement by taking advantage of the tax benefits that life insurance policies offer.

With a LIRP, policyholders make regular premium payments, which are invested in a separate account that grows tax-deferred. The policyholder can then withdraw the accumulated funds tax-free during retirement. Additionally, if the policyholder passes away, the death benefit of the life insurance policy is paid out tax-free to the policy holder’s beneficiaries.

LIRPs can be complex financial products, and it is important to fully understand the costs, fees, and potential risks before investing in one. It is recommended to consult with a financial advisor before considering a LIRP or any other financial product.

What Is a Life Insurance Retirement Plan (LIRP)

A Life Insurance Retirement Plan (LIRP) is a financial product with a strategy that combines life insurance with a retirement savings account.

It allows individuals to accumulate tax-free savings over time while also providing a death benefit to their beneficiaries if they were to pass away.

Unlike traditional retirement accounts, LIRPs have no contribution limits and do not require minimum distributions, making them an attractive option for high earners or individuals seeking tax-efficient ways to save for retirement. However, they can also come with high fees and complex structures, so if you are considering signing up for a LIRP, it is important to carefully evaluate the costs and benefits before investing in one.

About Cash Value

In Whole Life, the cash value is an investment component that increases tax-free over the course of the policy’s life. It is a part of permanent life insurance policies and is a living benefit feature that the policyholder can have and use during their lifetime.

The cash value is the amount of money that has accumulated in the policy over time and can be accessed by policyholders in various ways, including a loan against the cash-value or a withdrawal.

In other words, cash value can be defined as the amount of money that an asset, such as a life insurance policy or an annuity, is worth if it were to be surrendered or cashed out before the end of its term.

In the context of a life insurance policy, the cash value represents the amount of money that the policyholder would receive if they were to surrender the policy to the insurance company before the death benefit is paid out.

Over the years, cash value increases as the policyholder pays premiums and earns interest on the policy. In other words, the cash value is the equity that the policyholder has built up in the policy.

The growth of cash value is tax-deferred, but keep in mind that withdrawals may be subject to taxes and penalties.

You Can Use A LIRP To Fund Your Retirement

One of the main benefits of using a LIRP to fund a retirement is that it can provide a tax-free income stream once retired. This can be particularly advantageous for individuals who expect to be in a higher tax bracket in retirement than they are currently in.

Keep in mind that there are also some potential drawbacks to using a LIRP. These can include high fees and commissions, the possibility of the policy underperforming, and the fact that withdrawals or loans from the policy’s cash value can reduce the policy’s death benefit.

Fund Your Cash Value

When funding a life insurance retirement plan, the policyholder pays regular premiums, which are used to fund the life insurance coverage and the savings component.

The cash value of the policy grows tax-deferred, meaning that the policyholder doesn’t have to pay taxes on the growth until they withdraw the money.

There are other ways to fund cash value:

Lump-sum Contributions

You can make a one-time lump-sum contribution to your life insurance policy to increase the cash value immediately. This can be a good option if you have a windfall or a lump-sum payment from another source.

Transferring Assets

You can transfer assets such as stocks, bonds, or real estate into your life insurance policy to increase the cash value. This can be a tax-efficient way to transfer wealth to your heirs.

Loans

Some life insurance policies allow you to take out loans against the cash value. This can be a way to access the cash value without triggering taxes or penalties.

Dividends

If you have a participating life insurance policy, you may receive dividends that can be reinvested into the policy to increase the cash value.

Use The Cash Life Insurance After Retirement

Life insurance cash value can be a valuable asset to have after retirement. If you’ve been diligently paying premiums on a whole life insurance policy for many years, you may have accumulated a significant cash value in the policy.

This cash value can be used in a number of ways during your retirement years, such as supplementing your income, paying for unexpected expenses, or leaving a legacy for your loved ones. You can withdraw the cash value, take out a loan against it, or use it to pay your premiums.

Long-term Care Support

One way to finance long-term care and support in old age is by tapping into the cash value of a life insurance policy.

Since the cash value in the policy can be accessed by policyholders in various ways, including a loan against the cash value or a withdrawal, it can provide policyholders with a source of funds to pay for long-term care and support without having to surrender the policy.

LIRP – Pros and Cons

Life insurance retirement plans can be a valuable tool for securing your financial future in retirement. In the table below are the advantages and disadvantages of LIRPs:

| Pros | Cons |

| Tax-free income in retirement | Limited returns |

| Guaranteed death benefit | High fees |

| Protection from market downturns | Limited flexibility |

| No contribution limits | No guarantee of coverage |

| Flexible | May require ongoing contributions that aren’t tax-deductible |

| Estate planning benefits | Savings potential limited by cost of death benefit |

| Protection from creditors | Contributions are not tax deductible |

Plans included in LIRPs offer a combination of life insurance coverage and investment options to help you build wealth over time.

With careful planning and consideration, a life insurance retirement plan can help ensure that you have the resources you need to enjoy a comfortable retirement.

Who Needs Life Insurance Retirement Plan

Life insurance retirement plans can be beneficial for:

- Individuals who want to secure their financial future in retirement. LIRPs offer a combination of life insurance protection and savings, with the goal of providing a source of income during retirement.

- Individuals who have dependents or beneficiaries that rely on their income. These individuals should consider a life insurance retirement plan to ensure their loved ones are financially protected in the event of their unexpected death.

- Those who are concerned about outliving their retirement savings may also find a life insurance retirement plan to be a helpful tool in achieving financial security in retirement.

LIRP Costs

Upon your retirement, it’s important that your policy should still be funded through an IRA or a 401 (k) retirement account.

On the other hand, cash value life insurance has limited investment options and lower rates of return when compared to a 401(k) or IRA.

Please refer to the table below for examples:

| Aspect | IRA | 401(k) | LIRP | Annuity |

| Growth | Tax-free | Tax-deferred | Tax-deferred | Tax-deferred or free |

| Contribution Limits | $6,000 | $19,500 | Varies | |

| Income Start Date | Age 50+ | Age 50+ | Age 50+ | Age 50+ |

| Income Taxes | Tax-free | Taxed | Tax-free (loans) | Taxed or Tax-free |

Like any financial product, a LIRP has costs associated with it, and it’s important to understand these costs before deciding whether a LIRP is right for you.

Popular Life Insurance Companies LIRP Rates

Below is a table of the top 5 popular life insurance companies:

| Equitable | Affordable, low cost rates for older individuals. |

| Pacific Life | Has the lowest average term life prices for buyers aged 70 years old |

| Penn Mutual | Offers a great combination of solid, competitive policy rates, and financial strength. |

| Protective Life | Low rates for term life insurance that’s ideal for seniors. |

| Transamerica | Offers excellent policy illustrations. |

Life Insurance Retirement Plans Vs. 401(K)S & IRAs

LIRPs and 401ks/IRAs are both retirement savings vehicles with unique features. Their differences are stated in the table below:

| LIRPs | 401(K)S & IRAs |

| Life insurance retirement plans are a good choice for high-income earners who have reached the full capacity of their contribution limits to other retirement plans and are in search of alternatives for additional tax-deferred savings. LIRPs offer tax-free growth and withdrawals. | 401(K)S and IRAs are more widely available and provide a much larger range of affordable investment options.These offer tax-deferred growth and taxable withdrawals. |

LIRP As An Investment

LIRP is designed to provide tax-free income during retirement, making it an attractive option for those looking to maximize their retirement savings.

Here are a few ways to use life insurance retirement plan as an investment:

One way to use a LIRP is to invest in a diversified portfolio of stocks, bonds, and other assets, which can provide steady returns over time.

LIRPs offer flexibility in terms of how much you can contribute and when you can withdraw funds, making it a customizable option for your specific retirement goals.

Another way to make LIRP as an investment is the death benefit, which can guarantee your beneficiaries with a tax-free payout, ensuring your legacy and providing financial security for your loved ones.

FAQ

How does life insurance work as a retirement plan?

Life insurance policies can also be structured to accumulate cash value over time, which can be used as a retirement savings vehicle.

One type of life insurance that can function as a retirement plan is permanent life insurance, which includes whole life, universal life, and variable life insurance. Mostly, these policies come with a cash value component that increases tax-free over time. Policyholders can take a loan against the cash value or withdraw it as needed to use as their retirement income.

Is it advisable to cash out a life insurance retirement plan?

Using a life insurance retirement plan can be a viable option for some individuals, but it may not be suitable for everyone.

LIRPs can be an excellent option for those looking to access funds from their life insurance policy upon retirement. But, cashing out also has its potential drawbacks, such as the potential loss of the death benefit that will someday be of use to the beneficiaries.

Last Words

A life insurance retirement plan is a financial feature that is both life insurance and an investment component to help save for retirement. It can be useful because it offers a tax-advantaged way to save money, offers guaranteed death benefits to protect loved ones, and can potentially provide a steady stream of income following retirement. By starting early and making consistent contributions, policyholders can build a nest egg to help support their retirement years.

Sources

Insurancereviews.org follows stringent sourcing guidelines by utilizing peer-reviewed studies, academic research institutions, and industry associations to ensure the reliability and accuracy of our content. We refrain from using tertiary references and prioritize primary sources. To learn more about our commitment to delivering up-to-date and accurate information, please refer to our editorial policy.

- https://www.investopedia.com/articles/personal-finance/112614/strategies-use-life-insurance-retirement.asp – April 2023

- https://www.aflac.com/resources/life-insurance/life-insurance-retirement-plans-lirp.aspx – April 2023